How you can set up your emergency fund

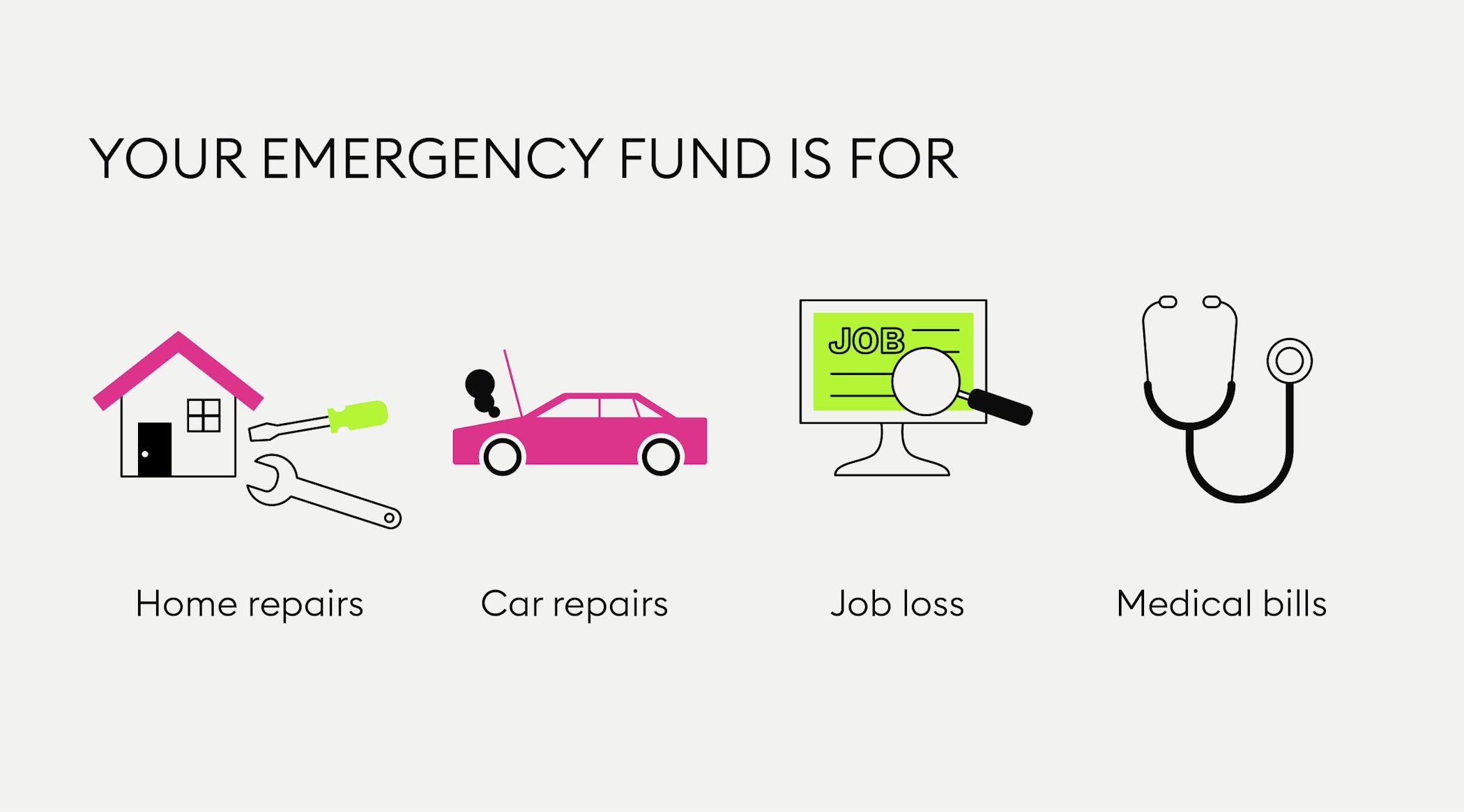

It is important to have an emergency fund in order to safeguard your personal financial goals. Therefore, setting money aside for unexpected expenses and difficult times is absolutely necessary.

Open a separate savings account for emergency savings only. Define the total amount you want to save each month, i.e. how much money you should put aside from each paycheck.

Pay off any credit card debt.

The general recommendation by experts is to have three times your monthly income set aside for emergencies, or, if you can, six times your monthly income.

Next to your current account (aka transactional account or debit account) for deposits and withdrawal of your income and your expenses, there are a number of other financial tools you should have in place for basic money management. One of them is a personal emergency fund.

How can I set up my emergency fund?

Instead of putting your extra cash in a household mason jar or a piggy bank (where it’s tempting to pick out five euros for a coffee or two), we recommend opening a separate savings account (either with your own bank or another one) as your emergency fund. This account should be separate from your daily spendings, i.e., you should not be able to spend any of it by using your normal bank card.

Setting up a savings account with your bank is relatively easy, you can either do it online with your banking app, or call them and have it set up within minutes. If your bank doesn’t offer an additional savings account, you could also look for free bank accounts and use such an account for your emergency fund.

What to do before setting up an emergency fund

While it is important to start your emergency fund as soon as you can, it is also important that any debts you may have should be paid off before you start your emergency fund. This rule also applies before you start investing in general. Paying off your bank overdraft and keeping expenditures with your credit card at a low level is an essential step in developing healthy financial habits.

New to Bitpanda? Register your account today!

Sign up hereHow much should I save for emergencies?

The first step of setting up any emergency fund is calculating how much you can actually set aside each month after receiving your salary and making sure you can still pay your bills and necessities. Simply write down the amount in your notebook or excel spreadsheet for your budget for the week, or find another budget method that works for you.

Based on the budget you have, you can then decide how much you want to put into your emergency savings or investment account. For example, you could decide to save 20% of your paycheck each month. Of course, if you manage to set aside more, even better! Once you have figured out which amount should go towards your emergency fund each month, make sure that you set up an automatic transfer from your bank account to your savings account the day after payday.

The overall recommendation is to have at least three times your monthly income set aside for emergencies, or even better, six times your monthly income. The reasoning behind this is in case of an unforeseen emergency, you can live off your emergency fund for three to six months. This rule is of course influenced by additional factors, such as social security and government aid in the country you live in. But no matter your situation: at least three times your monthly income is a good rule of thumb.

Maybe you are automatically thinking “I can’t save that much!”. However, the aim of an emergency fund is not to accumulate a lot of money quickly, but to have a cushion set aside to give you peace of mind and to have insurance in case the unthinkable happens. At the end of the day, having an emergency fund is all about planning for the future and the unpredictable events that life may throw at you, as well as potentially growing valuable interest.

This article does not constitute investment advice, nor is it an offer or invitation to purchase any digital assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in digital assets carries risks in addition to the opportunities described above.