What is a shareholder?

A person who holds at least one share of the stock of a company is referred to as a shareholder or stockholder.

A shareholder participates in the success (or failure) of the company in which they own shares. This is through rising (or falling) share prices and by dividend distribution.

If a stock corporation decides to distribute profits to its shareholders, every shareholder is entitled to a share in the profits.

The amount of the profit distributed depends on the type and number of shares held by a shareholder.

A stock corporation is not obliged to distribute its profits or part of its profits to shareholders.

In principle, almost any private individual can become a shareholder in a stock corporation, as well as in legal entities such as other companies and institutions, subject to the legal provisions in the country of residence of a shareholder. If you invest some of your assets by buying shares (stock) of a company, it basically means that you are co-owner of the company and of a proportion of the company’s value.

Shareholders vs. stakeholders

Although the terms “shareholder” and “stakeholder” are often used interchangeably, they don’t mean precisely the same. Stakeholders in a company are all groups that are affected by the company’s actions and performance in some way and need to be taken into consideration. This includes shareholders, employees, customers, suppliers and many others. Therefore, a shareholder is always a stakeholder in a company but not all stakeholders are necessarily shareholders.

What are public companies?

Thousands of companies worldwide offer interested investors the opportunity to invest in shares of their company and to become shareholders. If a company has the status of a “public limited company” (in the UK) or a “publicly traded company” or “public company” (in the USA), this means that ownership of this company is structured through shares of stocks with various types of shareholders owning different proportions of corporate stock.

If a company is “publicly listed”, this means that the company has sold shares of stocks in the scope of an initial public offering (IPO) to interested investors, and its shares are traded on a stock exchange in compliance with national regulatory requirements, such as securities law.

What is a shareholder structure?

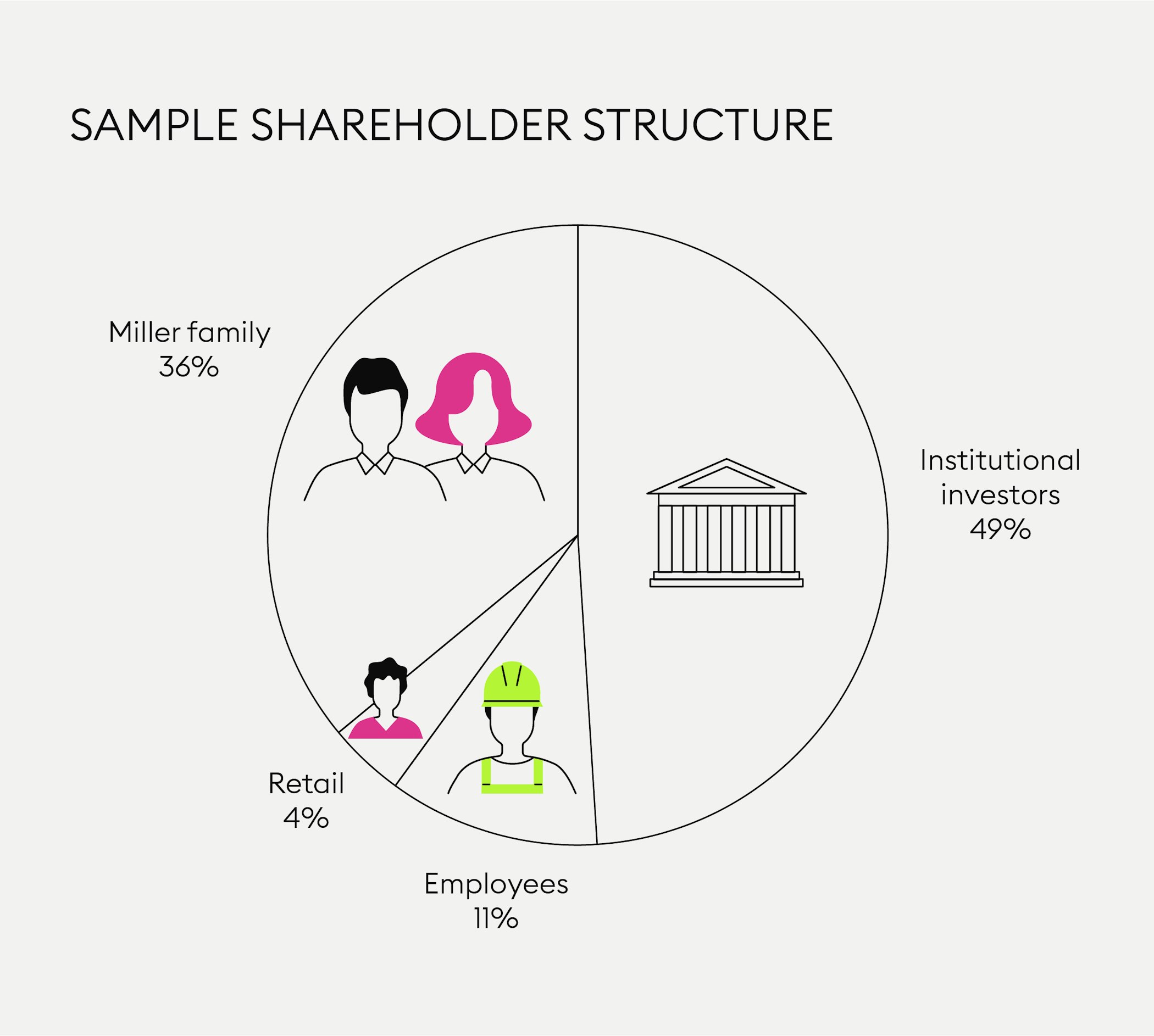

Sometimes, pie charts are used to illustrate the shareholder structure of a company, indicating who or which groups are invested in company stocks, or according to the region of shareholder residence. Savvy investors analyse this structure to see which shareholders hold a large proportion of the voting rights, as they tend to have influence on the corporate strategy of the company.

If a family holds a large part of the outstanding shares, it is usually in the interest of the family to pursue a strategy that adds value to the company over the long term. However, disputes in the family can also have a paralysing effect on the company.

The shareholder structure can also indicate the probability of takeover. If a certain shareholder has been expanding their stock of shares in a company over time, a takeover could be imminent. Even a takeover attempt could lead to significant share price increases.

Finally, if the managers of the stock corporation own shares in the company, they are likely to think like entrepreneurs and to pursue the interests of all other shareholders, likely leading to higher returns in the medium term.

New to Bitpanda? Register your account today!

Sign up hereHow can I become a shareholder?

You become a shareholder by buying shares of company stock. However, there are a number of things to consider before you start investing in stocks if you are a complete novice to investing.

Make sure your personal finances are on track

Before investing, you should make sure that your household budget is set up and in order, that you don’t have any credit card debt, that you have set up an emergency fund and that you have a clear goal that you’re working towards.

While having your savings set aside, don’t forget that their value may decrease over time since the interest you receive on savings is very low - and if inflation rates exceed interest rates, you may even lose money. Therefore, it is important to invest part of your money to make returns in the long term.

Understand why you want to buy stocks

By buying stocks, you essentially become the co-owner of a share of a company. So it’s important to understand which companies you’re investing in. Do they align with your own goals and personal values?

Before you start investing in stocks, you should know how you can profit. The company issues stocks to collect funds for its further growth and to increase its value. If you own stocks of a company and the company performs well, you also make money. There are two ways to make money off stocks: you wait to buy them at a relatively low price and sell them again for a profit after the price increases via a broker on a stock exchange, or you receive a small part of the company’s profit as a dividend.

Where can I buy shares?

If you are interested in becoming a shareholder and getting into trading on the stock exchange, you need to set up a brokerage account with a broker to buy and sell stocks.

A stock exchange works similar to an auction house: interested buyers and sellers submit the price they are willing to sell for (sell price) or to buy for (ask price) via the broker, and if two prices match, the order is filled.

What are your rights as a shareholder?

Since you literally become a “holder of shares” by buying a company’s shares, it is in your interest that a company is well-managed and geared towards growth in order to make gains from your investment over the long term.

Therefore, it is safer to only invest money you will not be needing any time soon. Before deciding to buy shares, also make sure that you are willing to invest the time to regularly monitor the performance of the company you are invested in.

To ensure shareholders can exercise their rights, the management board of a publicly listed company is obliged to invite all its shareholders to an annual general meeting at least 30 days in advance to vote on important decisions regarding the performance and plans of a company.

What is the annual general meeting?

At the annual general meeting, shareholders have the right to vote on “discharging the management and supervisory boards of the company”, indicating that they support these boards and trust their actions. Shareholders also get to vote on the use of retained earnings of the company for the previous year which is of special importance to shareholders since it affects the issued dividend - the investors’ gain.

What are the shareholder obligations?

A shareholder has the obligation to pay the capital for the share they are buying and has a duty of loyalty towards other shareholders. This means if a shareholder exercises his voting right to create special advantages for themselves or a third party which harms the company or the other shareholders without compensation being granted to these shareholders, the resolution in question can be challenged. Further obligations of shareholders are at the discretion of each share-issuing company.

DISCLAIMER

This article does not constitute investment advice, nor is it an offer or invitation to purchase any crypto assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in crypto assets carries risks in addition to the opportunities described above.