What are Smart Contracts and how do they work?

As you learned in the Beginners’ section of the Academy, smart contracts fundamentally act as the fuel for the growth of the Ethereum network in line with the goal of Ethereum to further advance use cases for blockchains.

A smart contract is a self-enforceable, digital representation of a traditional contract

The idea behind smart contracts was introduced by Nick Szabo in 1994 to decrease the level of risk for contracting parties

The Ethereum Network popularised smart contracts at scale

A smart contract is the foundation containing the fundamentals of each ICO

In this article, you are going to learn about smart contracts.

What are smart contracts?

The earliest precursors of smart contracts were POS payment terminals and vending machines. Using a vending machine, you put in the amount of money that equals the posted price for the item you want and within moments, you receive said item directly through a slot at the bottom of the machine.

Thus, both reception of the payment and the releasing of the item are automated in the purchase process. In essence, smart contracts are created to automatically execute and complete processes, such as a payment process, in digitised form.

Both reception of the payment and the releasing of the item are automated in the purchase process.

Digitised execution

In 1994, Nick Szabo, a well-respected cryptographer who is also an authority on Ethereum, came up with the idea to use computer protocols to support the execution of contracts over computer networks. He wrote in a blog article:

”Smart contracts reduce mental and computational transaction costs imposed by either principals, third parties, or their tools. The contractual phases of search, negotiation, commitment, performance, and adjudication constitute the realm of smart contracts. This article covers all phases, with an emphasis on performance. Smart contracts utilize protocols and user interfaces to facilitate all steps of the contracting process. This gives us new ways to formalize and secure digital relationships which are far more functional than their inanimate paper-based ancestors.”

Immutable contracts written in code

Ethereum smart contracts are self-enforceable, immutable contracts written in computer code. They are autonomous, accurate and immutable. The reason why Ethereum is the technology of choice that offers itself for application, and not Bitcoin, is the limited scripting ability of Bitcoin.

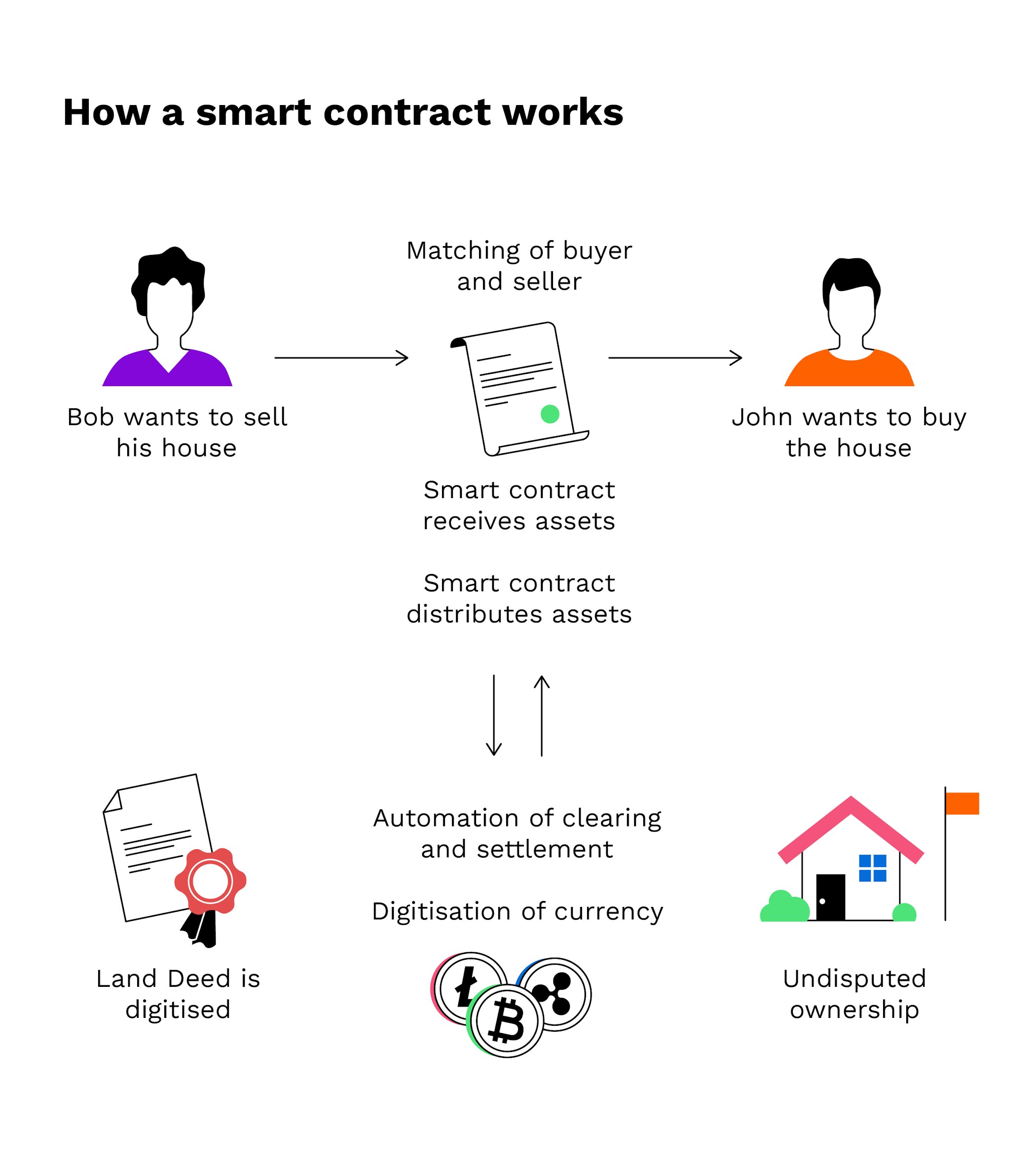

In some ways smart contracts are similar to the digital representation of traditional contracts, however, in essence they are a collection of functions and data stored on specific addresses on the blockchain. Data can be queried using functions depending on the implementation of the smart contract, for instance to check if an account has access to the funds to be transferred.

Ethereum smart contracts are self-enforceable, immutable contracts written in computer code.

Mental transaction costs and market translators

Szabo argued that mental transaction costs - namely the thought processes of a consumer before making a buying decision - posed a much greater hurdle in agreeing on terms behind a contract than computational transaction costs. Mental transaction costs are caused by an evaluation by a party of whether something is worth buying in the first place. Smart contracts solve this dilemma because they are coded to respond to the environment according to certain contractual terms such as price signals, preferences of customers or any kind of event desired.

So-called market translators in their most basic form obtain market prices automatically and input partial user preferences before “translating” the “source contract” into the “target contract”. Szabo outlines this in the analogy of Alice and Bob negotiating via market translators based on their preferences and market prices, until the smart contract is executed.

New to Bitpanda? Register your account today!

Sign up hereUse cases of smart contracts

Thus a smart contract consists of code that self-executes once certain conditions are met.

The range of applications is vast. First and foremost, smart contracts are highly suited for usage in financial services and banking, such as for payments and settlements and mortgages. Further potential use cases include applications where predictions and escrow are involved, such as disbursements of funds in case certain conditions materialise, as well as insurance claims and estates, facilitating procedures and no longer requiring a middleman. Finally, large-scale usage of smart contracts began with the emergence of ICOs where smart contracts enable transparent and fair conditions for token sales.

Smart contracts are highly suited for usage in financial services and banking, such as for payments and settlements and mortgages.

On the downside, since the contract performs exactly how it is coded and can never be changed, the immutability of a smart contract may also turn out to be a curse instead of a blessing. Hence, any errors in the code of a smart contract may carry risks and consequences, such as the wrong amount being distributed to the wrong recipient.

Are you ready to buy cryptocurrencies?

Get started nowDISCLAIMER

This article does not constitute investment advice, nor is it an offer or invitation to purchase any crypto assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in crypto assets carries risks in addition to the opportunities described above.