What is Ethereum?

Ethereum is a second generation blockchain widely considered to be the second most popular crypto after Bitcoin. The currency generated by the Ethereum blockchain is called Ether. Ethereum also functions as an operating system for the development of decentralised applications (DApps) and smart contracts.

Ethereum is currently the second most popular cryptocurrency after Bitcoin

Next to issuing a cryptocurrency called Ether, the Ethereum blockchain also functions as a development platform

Ethereum hosts DApps, which are programs, services and games created by developers and that are not controlled by a central authority

It is possible to create one’s own token currency that runs on the Ethereum blockchain

The Ethereum price reached its all-time high of €4.310,99 in November 2021

What is Ethereum?

Ethereum is a second-generation blockchain. Building on the original concepts first introduced by the creators of Bitcoin, Ethereum aims to advance and expand the use cases for blockchain technology to go beyond just peer-to-peer payments. Like Bitcoin, Ethereum is an open-source project that is not controlled by any central entity.

Next to producing its own cryptocurrency called Ether, the Ethereum blockchain’s other main use case is as a decentralised computing platform where developers can launch applications, databases, services, and games. These development capabilities are enabled through smart contracts.

ETH definition

ETH is the exchange code of Ethereum used on cryptocurrency exchanges. Though the ETH coin is used as a currency, many people buy it in order to invest in Ethereum, with the expectation that the value of ETH will increase over time.

The history of Ethereum

Ethereum was conceived by Vitalik Buterin, a programmer and the co-founder of Bitcoin Magazine. He set out to create a new platform for decentralised applications after he suggested the implementation of a scripting language in Bitcoin. Buterin outlined these concepts in a whitepaper under the title “A Next-Generation Smart Contract and Decentralised Application Platform.” Development of Ethereum began in early 2014 and was funded by an ICO which took place from July 2014 to August 2014. During this time, Vitalik Buterin became one of the most prominent public figures in the cryptocurrency sphere.

How does Ethereum work?

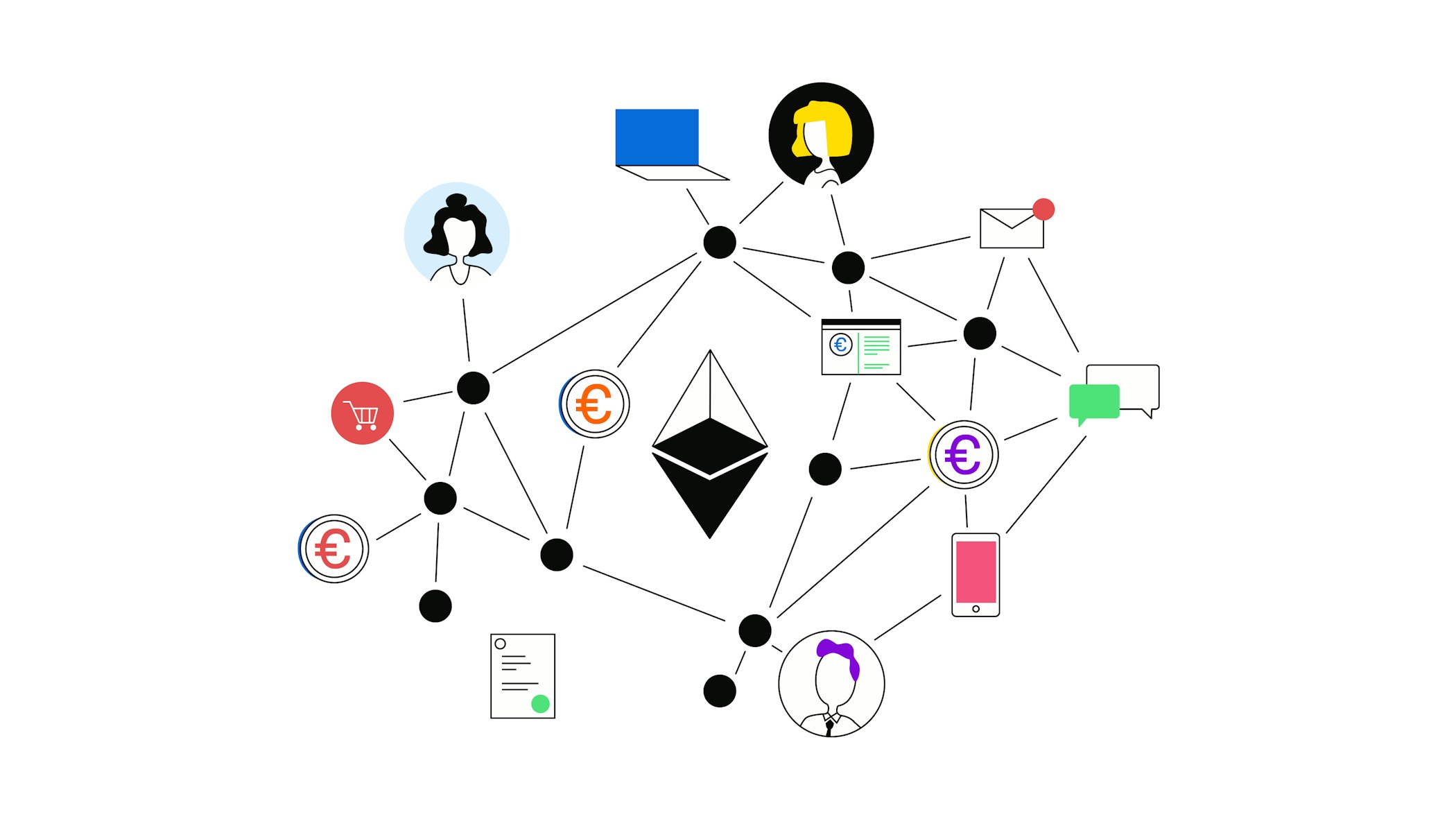

Ethereum uses a technology known as blockchain. The Ethereum blockchain is a digital ledger where Ether can be securely stored and exchanged, and where DApps can be created and developed through a type of computer protocol known as smart contracts.

Smart contracts

Whereas Bitcoin’s primary focus is on being a digital currency, Ethereum’s aim is to be a fully functional and open platform for developing applications - and this is where smart contracts come into play.

The idea behind smart contracts was first described by computer scientist and cryptographer Nick Szabo in 1996. He wanted to provide a secure and trustworthy way for contracting between strangers on the internet. His intention was to make traditional contracts less expensive and more secure at the same time. Following Szabo’s vision of secure and decentralised agreements, cryptocurrency systems are based on multilateral agreements of which all wallet-holders are parties.

A smart contract in its original context is a computer protocol that serves to digitally verify, enforce or to facilitate the performance and negotiation of a contract without third parties. This is how different players can come together and create applications and services on a decentralised platform, without the need of a formal authority to preside over the process. It’s an efficient and secure way to collaborate.

Computers in the decentralised Ethereum network have two functions: to record transactions and to produce smart contracts. For implementing tokens on the Ethereum blockchain, the technical standard used for smart contracts is ERC-20.

Mining and Proof-of-Work (PoW)

Up until September 2022, Ethereum transactions and the creation of new Ether coins were validated through a process called mining. This is where blocks are opened, information is entered, the block closes and a hash number is created. Each new block that is created contains information from the previous block, creating a chain that cannot be manipulated or altered.

In a Proof-of-Work (PoW) system, computers need to prove the energy expended in the mining process to make sure that everything is valid and correct. During the Ethereum 2.0 updates, Ethereum switched to a Proof-of-Stake (PoS) validation process.

Ethereum 2.0

Ethereum 2.0 refers to a series of updates to the Ethereum network that addressed some of the platform's key problems. Broken down into three phases, the Ethereum 2.0 updates were designed to make the entire platform faster, more scalable and more eco-friendly, the latter thanks to Ethereum’s switch to a Proof-of-Stake algorithm.

Proof-of-Stake (PoS)

Proof of Stake (PoS) is the second-most frequently used consensus mechanism in blockchain technology. Contrary to PoW, no mining is involved, which means the energy consumption is far below that of PoW. In order to validate transactions and create new Ether, participants in the Ethereum network who want to be involved have to put up a certain stake in the network, for instance by placing a certain amount of ETH in a wallet connected to the Ethereum blockchain. A staker is then chosen to create the next block on the chain, and they are rewarded for their efforts with transaction fees.

How to buy Ethereum?

To buy Ethereum, one must go through a cryptocurrency exchange like Bitpanda and purchase ETH with fiat currencies, e.g. euros or U.S. dollars. It’s recommended to first get familiar with the Ethereum price history and the current exchange rate. After purchase, your Ethereum investment can be viewed and accessed in a digital wallet that acts similarly to a banking app. You then have the option to hold on to your ETH or sell it again via the exchange.

What is the Ethereum price history?

Just like any other cryptocurrency, Ethereum is considered to be a highly volatile asset and the Ethereum price tends to fluctuate in response to events happening in the market. In 2015, soon after the launch of Ethereum, the price for one Ether averaged around €0,88. From there the value rose steadily and reached its first all-time high of €1.039,27 in January 2018. The price then fell again and stayed between €146 and €195 for a year and a half before skyrocketing in 2020. Ethereum’s current all-time-high of €4.310,99 was reached in November 2021.

How to use Ethereum?

The Ethereum Blockchain is like a distributed operating system with smart contract support. Therefore Ethereum offers not one, but multiple use-cases. These include:

Ethereum coin

In most cases, referring to the term “Ethereum” actually means “Ether”, the cryptocurrency running on the Ethereum blockchain. Ether is the network’s currency and Ethereum is the network itself. These terms are not to be confused with Ethereum Gas. Gas is the unit used by the Ethereum network to gauge the computational effort required to execute certain operations.

ICOs and tokens

Ethereum is and will likely remain the most important platform for Initial Coin Offerings (ICOs) in the crypto sphere. The bulk of all projects in the cryptocurrency sphere run on the Ethereum network.

DApps and Uniswap

DApps are built on the Ethereum blockchain. The advantage of DApps is that computation is decentralised. Developers are charged in Ether for using the computing power in the network. No single institution or authority controls the Ethereum network, thus essential components are distributed. For this reason it is almost impossible to attack the network, which in turn provides an enhanced customer experience of reliable and secure decentralised applications.

One of the most important recent additions is Uniswap, a Decentralised Automated Exchange (DEX) protocol. Uniswap is a DApp running on the Ethereum network that allows its users to trade and swap ERC20 tokens without any intermediary on a highly decentralised network.

Digital Identity

Identity theft and other issues involving privacy and security risks pose a threat to every internet user. Unique identifiers and patterns of use enable others to detect individual entities or their devices. However, digital identities could help to combat this problem. Elements of a digital identity include fundamental information about individual persons, organisations or electronic devices, such as usernames, passwords, date of birth, online search activities and so on.

One of the most disruptive use cases for the Ethereum network is the concept of a decentralised identity ecosystem. Decentralised identities (DIDs) are independent from any centralised registry, certificate authority or identity provider and are under full control of the owner who created the ID in the blockchain.

A blockchain identity relies on self-sovereign management across all borders and is anchored to a zero-trust datastore. Zero-trust datastores, such as the Ethereum Claims Registry, are based on a security concept which assumes no system, actor or service is automatically trusted. Instead, Zero Trust datastores ensure that every data unit and every data subject is verified before it controls or accesses data, thus greatly reducing the risk of identity theft.

Property Rights

Another use case for the Ethereum blockchain is end-to-end real estate transactions. Utilising blockchains greatly reduces engineering time and complexity in creating and executing legally binding agreements for selling and purchasing real estate. Using the Ethereum blockchain, a buyer and seller can negotiate, manage and execute their agreement using smart contracts without the need for a third party.

Are you ready to buy cryptocurrencies?

Get started nowThis article does not constitute investment advice, nor is it an offer or invitation to purchase any digital assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in digital assets carries risks in addition to the opportunities described above.