What is a dividend?

Have you ever wondered how you, as an investor, can directly benefit from the success of a company? Dividends are one such opportunity. If you own shares in a public limited company, you can receive a dividend payment at the end of the financial year – that is, a portion of the company's profit. The distribution is usually made in the form of cash or additional shares and rewards you for your investment. In this guide, you will find a definition of what a dividend is and learn everything about the distribution of dividends.

Simply put, a dividend is the portion of the profit that a public limited company distributes to its shareholders

Dividend payments can be made in the form of cash or additional shares and reward your investment

The amount of the dividend depends on the financial situation of the company and the resolutions of the annual general meeting

For investors, dividends are an important source of income and can contribute to long-term wealth creation.and are among the reasons why an investor would choose to buy stocks from a company

Definition: What does dividend mean?

A dividend is the portion of a company’s profit that is distributed to shareholders. It represents a form of profit-sharing and serves as a reward for the investment in the company. Typically, the board of directors of a public limited company decides together with the annual general meeting whether and in what amount a dividend distribution takes place. The payment of the dividend can, for instance, take place annually, semi-annually, or quarterly. The amount of the distribution depends on the financial situation and dividend policy of the company. For you as an investor, dividends can be an additional source of income, as they provide regular returns in the form of passive income and thereby contribute to your overall return.

Did you know that you can benefit from dividends not only with individual stocks? Dividend funds and dividend ETFs combine numerous companies that pay high dividends, offering you the opportunity to invest in dividend-oriented assets in a broadly diversified way. This way, you can achieve regular returns without having to spend much time selecting individual dividend stocks.

What types of dividends are there?

Dividends can be paid in different forms, depending on the dividend policy of the company. The types of dividends include:

Cash dividends: Here, as a shareholder, you receive a fixed cash amount per share directly into your account. This is the most common form of dividend distribution.

Stock or share dividends: Instead of cash, shareholders receive additional shares in the company, which increases their stake in the company.

Natural or in-kind dividends: The profit is distributed in the form of tangible assets, such as company products or other assets.

Special dividends: These are paid out as a one-time distribution, often in cases of exceptionally high profits or special events.

Interim dividends: A preliminary dividend paid during the financial year, before the final annual profit is determined.

Advance dividends: A dividend paid out before the final allocation of profits, similar to a prepayment.

Super dividends: This involves an additional amount paid above the regular dividend, often as a reward to shareholders in particularly successful years.

Preferred dividends: Shareholders of preference shares receive a guaranteed dividend, which is usually higher than that of ordinary shares.

Final dividends: The final dividend is distributed at the end of the financial year and is based on the final profit.

Repurchase dividends: Companies buy back their own shares, which increases the value of the remaining shares and represents an indirect dividend.

Explanation: How does the distribution of dividends work?

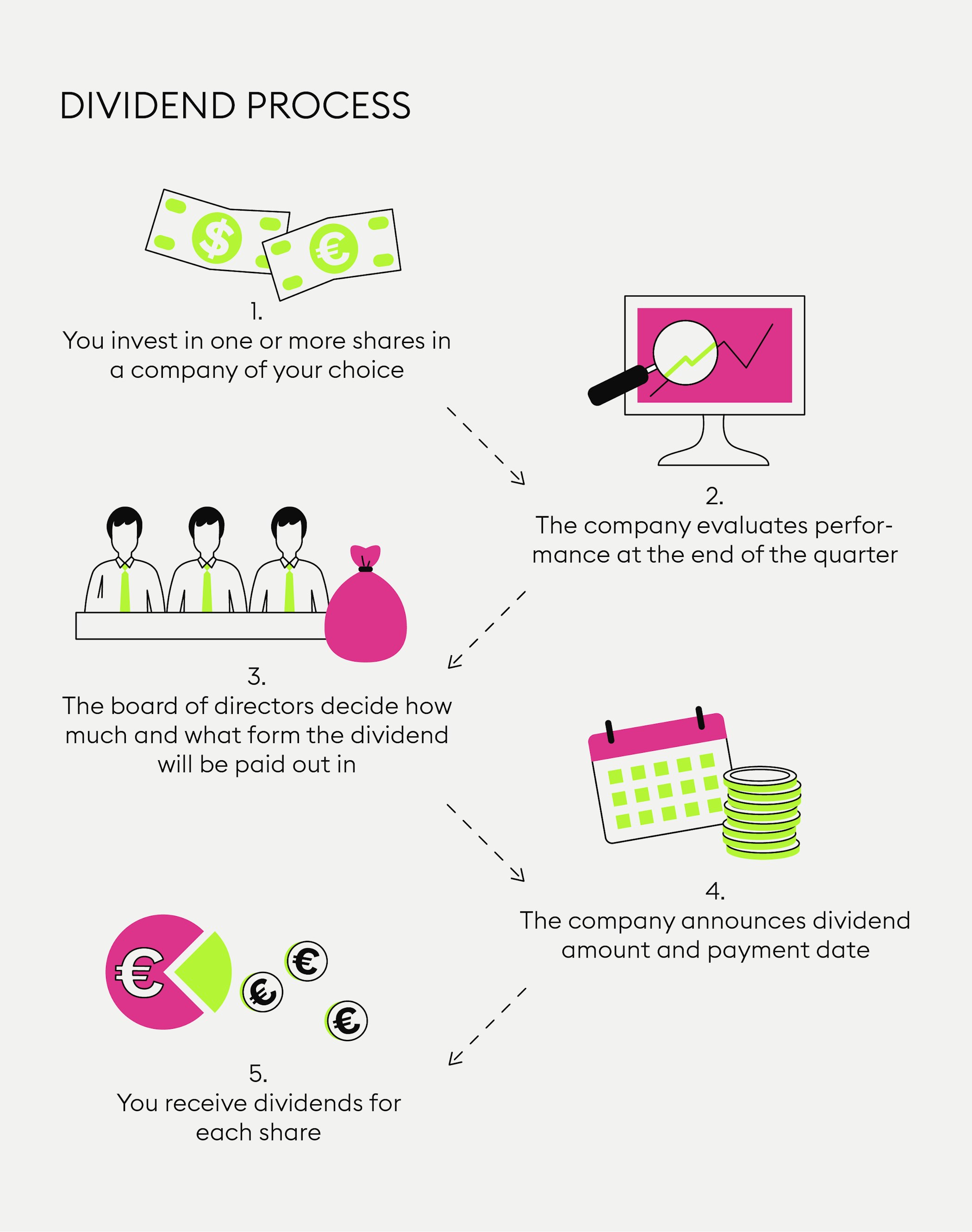

The distribution of dividends follows a clear process that involves several steps. First, the board of directors of a company decides whether and in what amount a dividend distribution should take place. The decision is reviewed and approved by the annual general meeting of shareholders. Once the dividend amount is set, the so-called ex-dividend date is determined. Only shareholders who hold the share on the trading day before this date are entitled to receive the dividend.

Formula: How are dividends calculated?

The dividend yield can be calculated using the following formula:

Dividend yield = (Dividend per share / Share price) × 100

Example:

Suppose a company pays a dividend of 5 euros per share, and the current share price is 100 euros. The calculation of the dividend yield is as follows:

(5 / 100) × 100 = 5%

This means that the dividend yield is 5%. If you own this share, you would receive 5 euros in dividends for an investment of 100 euros in one share.

Who receives dividends?

Dividends are paid to all shareholders who hold shares in their account on the so-called record date (the trading day before the ex-dividend date). This day is crucial, as it determines who qualifies as an entitled shareholder for the dividend payment. Holders of shares purchased after this date are not entitled to the current dividend distribution.

The following points are important to consider:

Shareholders of common and preferred shares: Both holders of common shares and preferred shares can receive dividends, with preferred shareholders often benefiting from a guaranteed or higher dividend.

Reinvestment programmes: Some investors opt to receive dividends not in cash but reinvest them directly into additional shares.

Institutional and private investors: Both large institutional investors and private investors are entitled to dividends, provided they are shareholders on the record date.

When are dividends paid out?

Dividends are usually paid to shareholders on the third day after the annual general meeting of a public limited company.

The key factors and deadlines to consider regarding dividend payments include:

Annual general meeting: During the annual general meeting, the board of directors and shareholders determine the amount of the dividend and the payment date.

Ex-dividend date: This marks the first day on which a share is traded without the right to the upcoming dividend.

Payment date: Typically, payment is made a few days after the annual general meeting.

Depending on the company, dividends may also be paid semi-annually, quarterly, or even monthly. You can check the company’s dividend calendar in advance to keep track of payment dates.

How are dividends paid out?

Dividends can be distributed to shareholders in different ways, depending on the company’s dividend policy. Most companies transfer a cash dividend directly to the shareholder's bank account or settlement account linked to their securities account.

Many companies or banks also offer investors the option to automatically reinvest their dividends into additional shares of the company. Over time, this can lead to a higher overall value due to the compounding effect. In some cases, dividends may also be paid in the form of tangible assets, such as company products or other assets.

New to Bitpanda? Register your account today!

Sign up hereAdvantages and disadvantages of dividends

Dividends offer numerous advantages for investors, but there are also some potential disadvantages that you should consider before investing in dividend stocks.

Advantages:

Dividends provide a reliable source of income that is paid regularly, independent of price movements.

For long-term investors, dividends can form a stable source of passive income, particularly during retirement.

Through dividend reinvestment programmes, you can use your earnings to acquire additional shares and benefit from the compounding effect.

Regular dividend distributions often signal that the company is profitable and stable.

Dividends can enhance the total return of an investment, even if the share price stagnates.

Disadvantages:

In many countries, dividends are subject to direct taxation, which can reduce net returns.

If a company earns less profit, dividends may be reduced or completely suspended.

A high dividend payout ratio often means fewer resources are available for the company’s growth and development.

Dividends are not guaranteed and can vary or cease from year to year.

Dividends alone do not protect against the risks of price fluctuations.

Conclusion: The importance of dividends for you as a private investor

Dividends can be an attractive way for private investors to generate regular income from their investments. They not only offer an additional source of returns but can also contribute to wealth accumulation in the long term through reinvestment. For investors who rely on passive income, dividends are an essential component of a diversified investment strategy.

However, the decision to invest in dividend stocks depends on your individual goals. Dividend-strong companies are particularly suitable if you seek stability and regular distributions. At the same time, you should bear in mind that dividends are not guaranteed and depend on the company’s financial situation.

Frequently asked questions about dividends

Here you will find answers to common questions about dividends.

How much is the dividend?

The amount of the dividend depends on several factors, including the financial success of the company, its dividend policy, and the resolutions of the annual general meeting. Companies typically set a fixed dividend per share, which is derived from the profit of the financial year.

Are dividends subject to tax?

Yes, dividends are generally subject to tax, as they are considered income from capital gains. In Germany, for instance, a withholding tax of 25% applies, plus a solidarity surcharge and, if applicable, church tax.

What is the dividend yield?

The dividend yield is a metric that measures the profitability of a dividend payment in relation to the share price. It indicates how high the annual dividend is compared to the current share price and is expressed as a percentage. The dividend yield is a tool to compare dividend stocks and assess their earning potential.

What is a dividend strategy?

A dividend strategy is an investment style in which investors specifically select stocks of companies that pay regular and attractive dividends. The goal is to create a stable income source and build wealth over the long term by reinvesting the dividends. There are various approaches, such as focusing on companies with high dividend yields or those that have consistently increased their dividends over the years.

More topics around private financial planning

Are you interested in learning about cryptocurrency trading? The Bitpanda Academy offers a wide range of guides and tutorials, providing deeper insights into blockchain networks, crypto trading, and much more.

DISCLAIMER

This article does not constitute investment advice, nor is it an offer or invitation to purchase any crypto assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in crypto assets carries risks in addition to the opportunities described above.