How can you set up your household budget?

Setting up a budget for your personal finances is essential for managing your money, your financial well-being and achieving your financial goals.

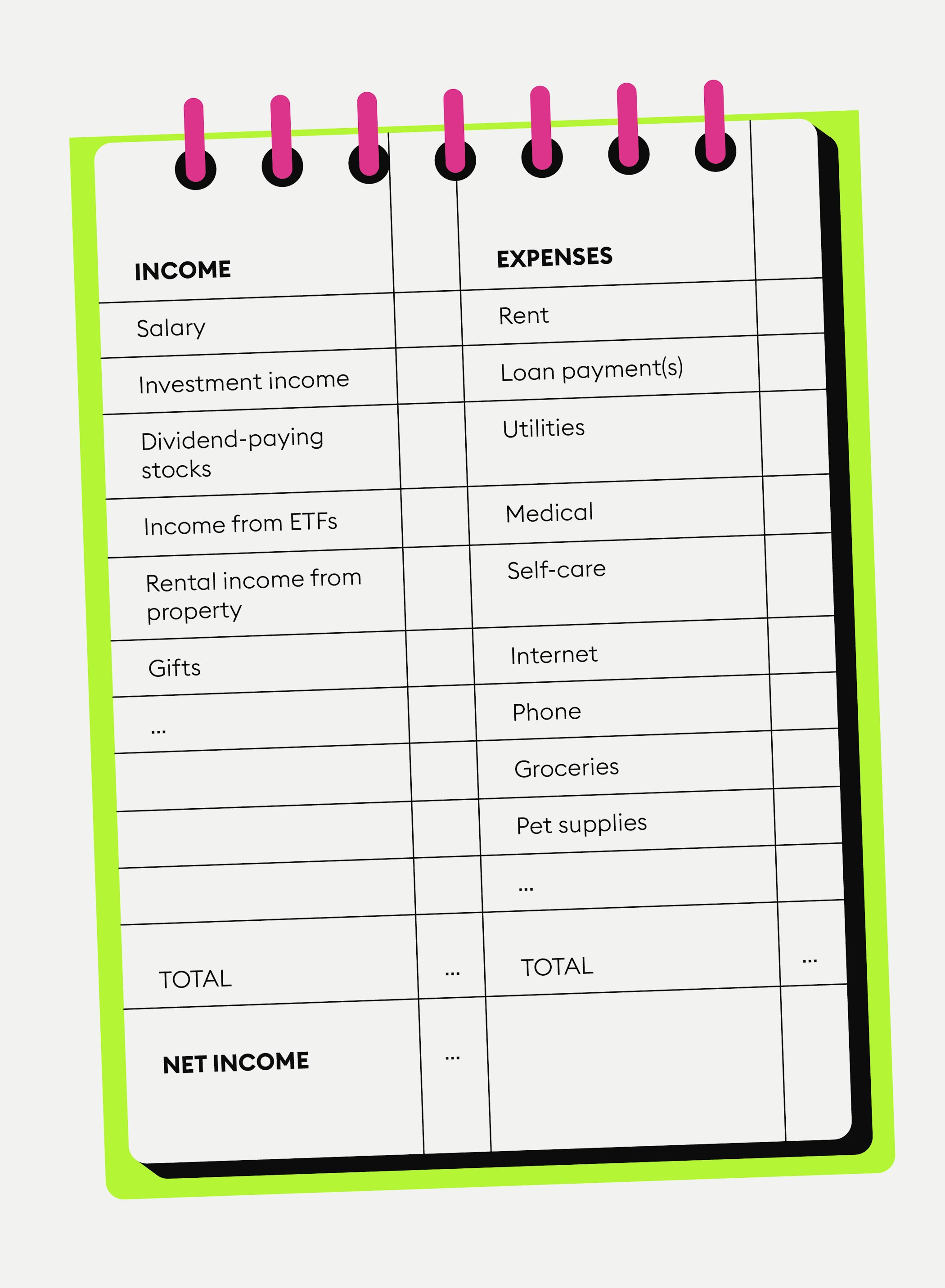

A household budget or personal budget is a table that lists your income against your expenses.

A budget helps you to monitor your personal cash flow and to track how and where you spend your money.

Budgeting is an essential task in any long-term money management strategy.

Even if you have never heard of a household budget or even a budget before, money management plans are used much more commonly than you may think. For instance, did you know that governments of nations set up national budgets structuring their spending? Just like companies that need to plan to manage their financial performance, it is important to take some time to draw up a personal budget for yourself and your household. This is a convenient and easy way of monitoring where you spend your money, to see where your income goes and which expenses you have. By doing so you will also be able to figure out how much money you can potentially save and invest.

How to make your income and expenses lists

Finances are one of the major causes of stress for many adults, but creating a household budget and sticking to this plan may help ease this anxiety. You only need a few things to start setting up and planning a budget for your individual household.

The best way to get started is to sit down and to give yourself some time to think about all the ways you are generating income and all the things that cost you money - or in other words, your assets and liabilities. Make two columns and write two lists. Or just simply copy the lists below. There are also lots of free spreadsheets available online which you can adjust to your budget needs. As there is no right and wrong in setting up such a list, feel free to adapt it to your own needs.

New to Bitpanda? Get started today!

Sign up hereSome examples of income (money flowing in) are:

Salaries and wages you get regularly and reliably from working

Bonuses you receive at work

Income from side businesses or additional jobs

Income from your investments (such as dividends from shares)

Passive income (such as royalties from books that you’ve written)

Royalties you receive from others using your intellectual property (such as music you’ve composed)

Income from renting out any real estate that you own

Social security payments and transfers of any kind you receive from governmental authorities such as family allowances and pensions

Money gifted to you (ie. from relatives)

Any other type of regular income

Some examples of expenses (money flowing out) are:

Payments for rent and utilities/mortgage on your house

Repayment rates for loans and debts of any kind (such as bank account overdraft or credit card bills)

Utility bills (electricity, water, heating, etc.)

Internet/phone/cable

Tuition for school, university, etc.

Groceries

Medical costs

Clothing

Insurance payments

Entertainment and dining out

Gym membership

Travel

Home improvements

Personal grooming (cosmetics, beauty appointments, vitamin supplements, etc.)

Anything else that you spend money on

After you have made your lists, you are going to need your bank statements and credit card statements. Looking at one average month (or more if you want) of spending, use the amounts you typically spend as reference values. Review all transactions - incoming and outgoing - in these statements. Don’t forget to include expenses that you do not have every month but maybe in other intervals. Look at the amounts you spend every month on each item and write them down for each item. Finally add up your income and add up your expenses.

How to calculate net income

Now you take the sum of your income and subtract the sum of your expenses that you have added up and write down the amount, regardless of whether it is positive or negative. The figure will hopefully be positive, meaning that you are not spending your entire income, or more than your actual income.

How to review your spending habits

Now it’s time to analyse your spending habits in closer detail. Are you possibly spending more money that you have coming in? If your expenses amount to more than you actually have incoming, this is known as “going over budget”. Carefully look at all the details in your spending list to figure out where you are spending too much money and where you could be spending less.

Adjusting your spending habits as quickly as possible will save you a lot of trouble later on. You should identify expenses that are not necessary or where you could switch to a cheaper option. It obviously depends on your personal situation, but earning more than you spend – even if it’s just a small amount – is crucial.

This article does not constitute investment advice, nor is it an offer or invitation to purchase any digital assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in digital assets carries risks in addition to the opportunities described above.