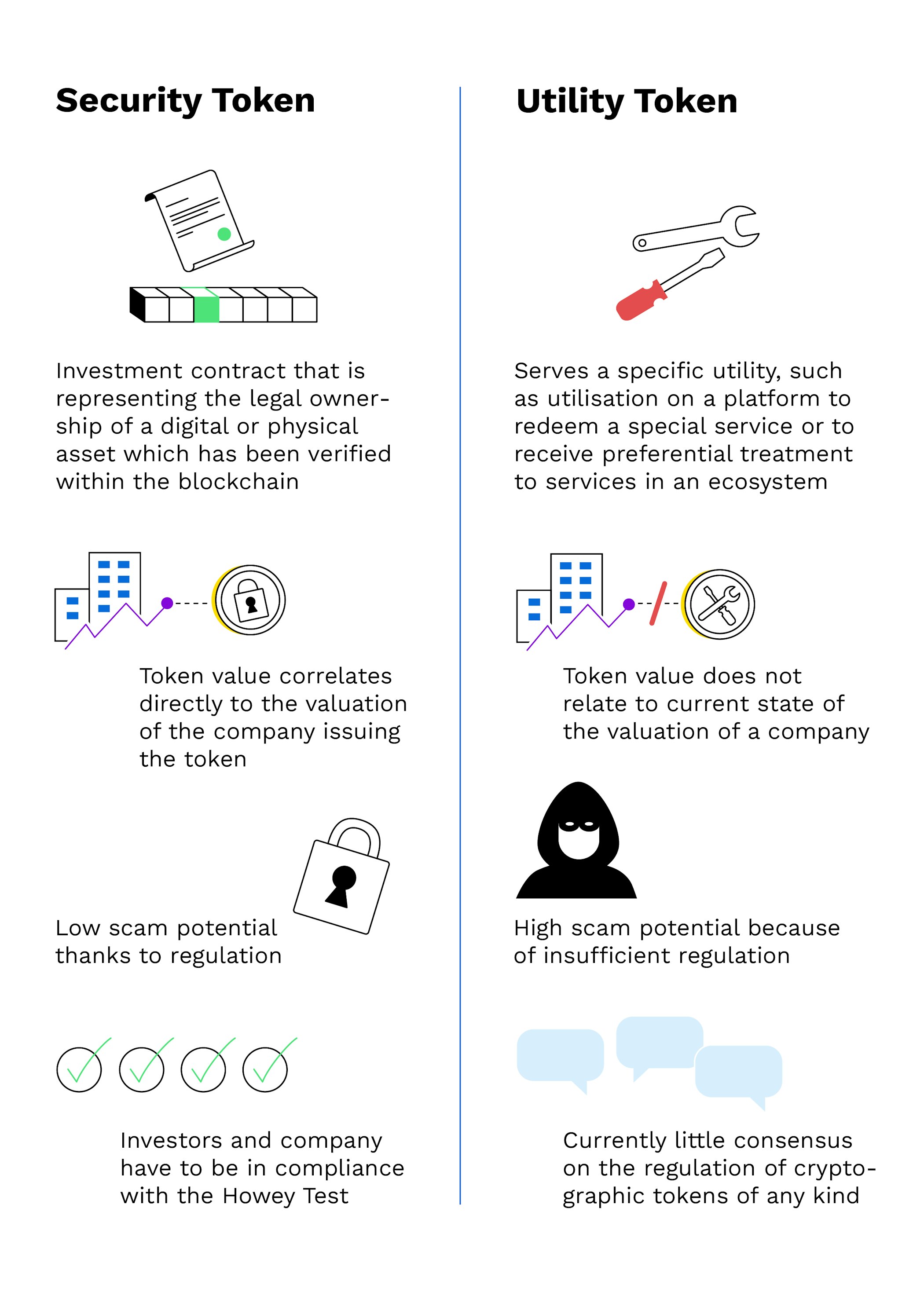

What is the difference between Utility Tokens and Security Tokens?

Ethereum remains the leading platform for token projects, but other blockchains are also gaining traction.

Unlike cryptocurrencies, which operate on their own blockchains, most tokens are built on existing blockchains

Ethereum, in particular, is renowned for its support of ERC20 tokens

Smart contracts are used to gather existing tokens and issue new tokens

Tokens are mainly used as a payment method for services, to represent voting rights in ecosystems or as digital assets

Token’s regulatory status is still evolving

As mentioned, most cryptocurrencies are based on their own blockchains. In some cases, however, such as Ethereum, tokens are regarded as separate projects that utilise the functionality of an underlying blockchain as a starting point for their own developments.

Security Tokens

A security token based on blockchain technology is separate from the security token that you need to access a sensitive network system such as a bank account. Also called an “investment token” or “equity token,” in the realm of blockchain technology a security token is a cryptographic token that is tied to a securities offering.

Rather than granting a tangible benefit for an investor such as access to an ecosystem, a security token typically represents a share in the company issuing the token. Investors who buy such tokens hope to turn a profit from investing. Security tokens utilise the speed and efficiency of blockchain technology while benefiting from government regulatory measures that offer increased protection from fraud.

In the United States, the Securities and Exchange Commission (SEC) is the authority in charge of regulating how a security is classified. The SEC also stipulates how companies should disclose their securities offerings. As you have already learned in lesson 10, the Howey Test is a methodology used to determine whether putting money into a business means you have “invested” in it.

Security tokens utilise the speed and efficiency of blockchain technology while benefiting from regulatory measures by governments.

The Howey Test was instituted by the US Supreme Court in 1946. It defines an asset as a security if "a person invests his money in a common enterprise and is led to expect profits solely from the efforts of the promoter or a third party."

Key Characteristics of Security Tokens:

Regulation and Protection: Security tokens are subject to regulations, providing increased protection against fraud. In the U.S., the SEC regulates security tokens and uses the Howey Test to determine if an asset qualifies as a security. This test defines security as an investment in a common enterprise with an expectation of profits derived from the efforts of others.

Blockchain Integration: Security tokens leverage blockchain technology for efficiency and transparency, making them attractive for both investors and issuers.

A token of steel

One example of a security token is Steelcoin, which stands as a pioneering security token that integrates steel with the Ethereum blockchain. As a regulated, transferable security under the EU Prospectus Regulation, Steelcoin is tied to the value of specific steel products. This allows investors to participate in the price performance of specific steel products—a vital industry impacting global infrastructure.

Key features of Steelcoin include:

Participate in the steel market: Offers exposure to the steel market, essential for infrastructure and industry.

Expert Collaboration: Developed in Austria in partnership with the renowned steel trading group Frankstahl.

Regulated Offering: Compliant with the EU Prospectus Regulation, ensuring robust investor protection.

Steelcoin represents a significant advancement in security tokens, merging cutting-edge blockchain technology with a fundamental commodity.

Other types of security tokens

There are several types of security tokens, each representing various asset classes and financial instruments. Below are some of the most common types:

1. Equity Token

What is it?: Represents ownership in a company, similar to traditional shares.

Key features: Provides dividends, voting rights, and other shareholder benefits. Equity tokens give investors a stake in the company’s performance and potential profits.

2. Debt Token

What is it?: Represents a loan or debt obligation, akin to bonds.

Key features: Offers fixed interest payments and a return of principal upon maturity. Debt tokens can be used by companies to raise capital while providing investors with regular income.

3. Asset-Backed Token

What is it?: Backed by physical or digital assets like commodities or intellectual property.

Key features: Provides ownership rights or a claim on the underlying asset. Asset-backed tokens allow investors to gain exposure to tangible assets without directly owning them.

4. Revenue-Sharing Token

What is it?: Represents a share of future revenue generated by a company or project.

Key features: Investors receive a portion of the revenue or profits, often based on the performance of the business or project.

5. Real Estate Token

What is it?: Represents ownership or a share in real estate assets.

Key features: Allows fractional ownership and investment in real estate properties, providing access to property markets with lower entry barriers.

6. Hybrid Token

What is it?: Combines elements of various security token types.

Key features: Offers a mix of equity, debt, and revenue-sharing features, tailored to specific investment and operational needs.

7. Governance Token

What is it?: Allows holders to participate in the decision-making process of a blockchain project or organisation.

Key features: Provides voting rights on protocol upgrades, project developments, or other key decisions, blending investment with governance.

8. Convertible Token

What is it?: Can be converted into other types of tokens or assets under predefined conditions.

Key features: Offers flexibility for investors, allowing them to convert their holdings based on certain triggers or events.

9. Structured Token

What is it?: Embeds complex financial instruments or strategies within the token itself.

Key features: Provides customised investment solutions, such as combining debt and equity features, or integrating derivatives and other financial products.

Utility Tokens

Utility tokens, on the other hand, serve a specific utility. Such a utility may be that tokens can be used on a platform to redeem a special service or receive preferential treatment for services. Utility tokens make up the majority of tokens issued in the scope of ICOs. They are primarily used by companies to raise interest in their products, and for application and value creation in services provided in blockchain ecosystems.

In contrast to security tokens, investors are not offered an actual stake in the monetary ownership of a company if they buy utility tokens. Therefore, utility tokens are not created as an investment opportunity in the original sense.

Utility tokens are primarily used by companies to raise interest in their products and for application in blockchain ecosystems.

Still, there is a common misunderstanding that when the number of people using a utility token increases, the value of the token will increase as well. In fact, a utility token’s investment value correlates to the actual demand for the utility token. As token availability is capped, token value is expected to increase in line with rising demand. If a token is tied to a DApp, the scaling up of a network may increase the value of a token.

Key Characteristics of Utility Tokens:

Functionality: Used to access services or features within a blockchain ecosystem.

Investment Value: Their value is linked to demand for their utility, not company valuation.

Regulatory Concerns: High potential for scams due to less stringent regulation compared to security tokens.

New to Bitpanda? Register your account today!

Sign up hereRegulatory issues

Around the world, the development of open banking is still in its early stages. Security tokens as well as utility tokens based on blockchain technology are expected to play an important role in the future of the digitisation of capital markets. However, currently, there is little consensus on the regulation of cryptographic tokens of any kind.

Regulatory agents in different countries are taking divergent approaches on how to classify cryptocurrencies and tokens in terms of due diligence requirements. Supervisory authorities around the world working towards clarification and coordination on a global scale remain essential ingredients in ensuring continued growth and innovation in the fintech industry.

Conclusion

Understanding the distinction between security and utility tokens is crucial for navigating the evolving blockchain landscape. While security tokens offer regulated investment opportunities, utility tokens provide access to services within specific ecosystems. As regulations mature, the role of both types of tokens in financial markets will continue to expand.

Are you ready to buy cryptocurrencies?

Get started nowThis article does not constitute investment advice, nor is it an offer or invitation to purchase any digital assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in digital assets carries risks in addition to the opportunities described above.