What is a Bitcoin halving?

A Bitcoin halving is a condition defined within Bitcoin’s protocol that requires the Bitcoin block reward to be cut in half every 210,000 blocks. The Bitcoin halving is arguably the most important event in the cryptocurrency world. So, whether you are a crypto novice or a seasoned investor, it’s essential to understand what the halving is and its impact on the market.

A halving of block rewards occurs automatically once a certain number of blocks has been mined.

The most recent Bitcoin halving event took place in May 2020. The next Bitcoin halving is likely to occur in April 2024.

The purpose of halving is to decrease the number of new coins entering the network.

A halving event includes the risk that miners may be less incentivised to mine Bitcoin.

What is the Bitcoin halving?

Bitcoin halving is a scheduled event in the Bitcoin protocol where the reward for mining new blocks is halved. It occurs every 210,000 blocks, roughly every four years, to control inflation and cap supply at 21 million bitcoins. The latest halving was in April 2024, reducing rewards from 6.25 to 3.125 BTC per block.

Cryptocurrencies like Bitcoin that are based on a Proof-of-Work (PoW) algorithm are produced by miners who are people with specially equipped computers that solve mathematical problems to create new blocks, release new coins into circulation, and get rewarded for their efforts.

Within the Bitcoin network, the initial block reward for miners was 50 BTC. Over time, this reward has been continuously reduced due to a special “halving” provision in the Bitcoin code. Though the Bitcoin halving dates are not guaranteed fixtures on the calendar, they are consistent. This provision states that the Bitcoin block reward should be permanently cut in half roughly every 210,000 blocks, or approximately every 4 years. The purpose of Bitcoin halving, along with the fixed total supply, is to decrease the number of new coins entering the Bitcoin network.

The total Bitcoin supply is fixed at 21 million bitcoins. This figure is based on calculations you can read about in the Bitcoin whitepaper. Once 21 million bitcoins have been generated by miners in the Bitcoin network, then the finite number of bitcoins that will ever be issued has been reached and no more bitcoins can be created.

Are you ready to buy cryptocurrencies?

Get started nowHow does a Bitcoin halving work?

A halving event is coded into a blockchain protocol from the launch of its genesis block, provided that the network is PoW-based. Fundamentally, this recurring event is specified in only two lines of code, one of which states when a halving happens, and the other specifies when the blockchain involved should stop halving. For Bitcoin, this is after 64 times.

The most recent Bitcoin halving event took place on 12 May 2020. When the Bitcoin blockchain reached the halving block, the halving event was executed almost instantly and the block reward was immediately decreased by half. Although the exact date is not confirmed, the next Bitcoin halving is scheduled to take place in April 2024.

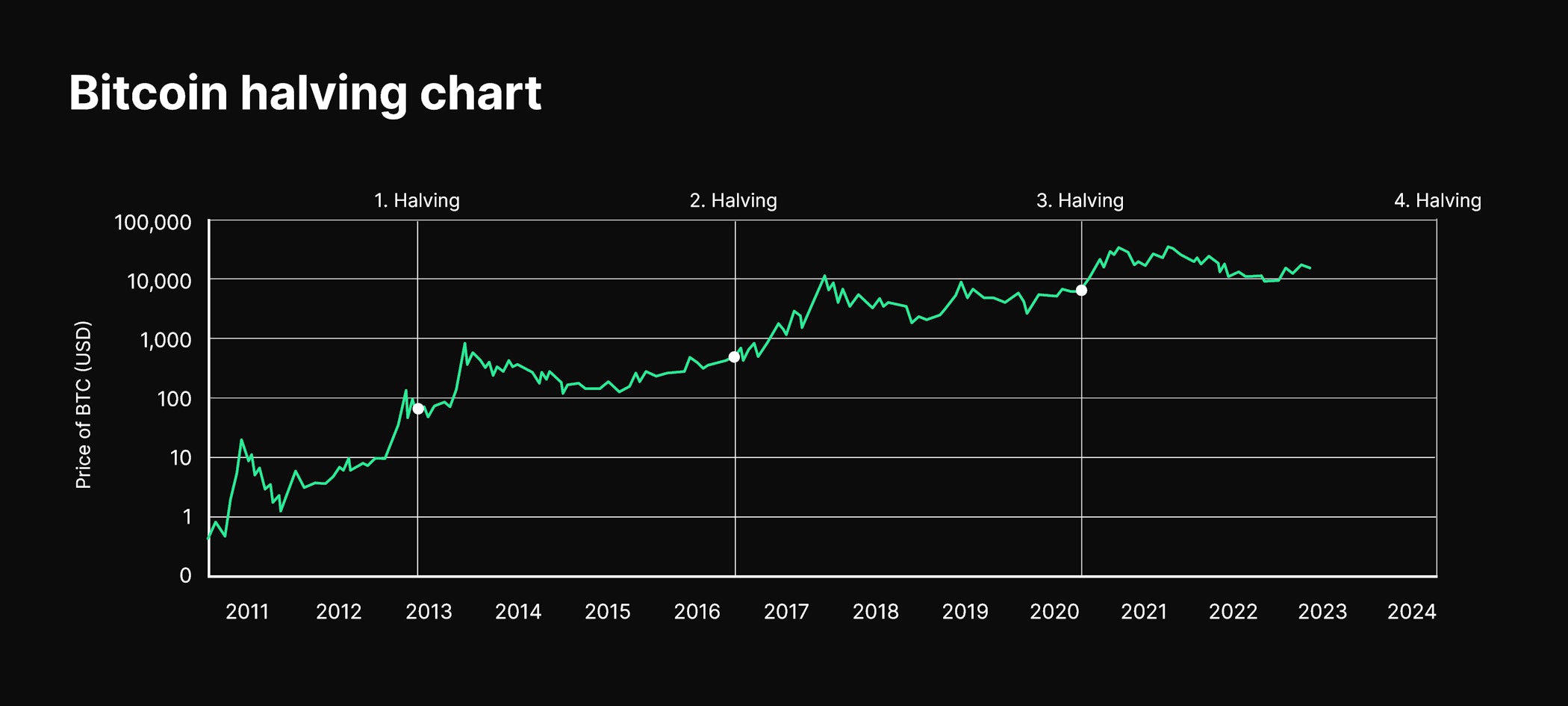

Bitcoin halving historical price development

In late 2012, the first halving dropped Bitcoin’s block reward from 50 to 25 BTC. Four years later, Bitcoin’s second halving reduced the network’s block reward again, this time to 12.5 BTC. After the most recent halving, the block reward is now 6.25 BTC per block.

While there are general expectations of a Bitcoin price jump around the time of a halving, such a development is by no means guaranteed. The expectation of a price increase is tied to the theory of supply and demand: An item’s price increases when there’s a limited supply of that item and decreases when there is a supply surplus. Fewer bitcoins entering into circulation may affect their price. But other factors influencing Bitcoin price development are equally significant, such as global events like the COVID-19 pandemic, the war in Ukraine, or the public opinion regarding the environmental impact and sustainability of mining operations.

Past Bitcoin halving events have demonstrated a positive impact on the market price. For example, if we look at the 2012 halving, the price of 1 BTC rose by 8,069% in the year following the halving. Moreover, one year after the 2016 Bitcoin Halving, we saw a 284% increase in the price of BTC. Consequently, the community is anticipating a price increase as a result of subsequent scarcity and past scenarios. However, we can only speculate on the trend ahead and there is no way to know for sure.

How does the Bitcoin halving impact miners?

After the upcoming Bitcoin Halving, the block reward miners receive will be halved to 3.125 BTC. As the block rewards become less significant, some miners may conclude that Bitcoin mining is no longer affordable due to rising electricity costs and hardware upkeep.

As miners won’t earn enough through new Bitcoin to justify their ongoing costs, the market will likely become more decentralised as a result. The overall hashrate of Bitcoin could decrease as miners shut down their farms or move to other proof-of-work cryptocurrencies with similar algorithms to Bitcoin. Nonetheless, the speed at which the blocks are mined and bitcoins are distributed into the ecosystem will not be affected, as the software is designed to adjust the difficulty of verifying Bitcoin transactions to maintain a steady amount.

On the surface, the Bitcoin halving is a policy to simply reduce what Bitcoin miners earn, but it’s actually a device to control Bitcoin’s inflation rate. Unlike fiat currencies like the Euro or the US dollar, which the government can produce at will, Satoshi Nakamoto developed strict limits. Therefore, there is a limit to Bitcoin’s total supply in order to avoid devaluation by the arbitrary issuance of new Bitcoin. Moreover, the halving mechanism means that the supply of new Bitcoin decreases over time. In many ways, Bitcoin is similar to scarce commodities such as gold, palladium or other precious metals. But unlike those assets, we can calculate and predict how the supply decreases over time and how much Bitcoin is still available to mine.

Will Bitcoin mining still be profitable?

Taking into consideration past events, profitability prospects depend on the price of Bitcoin at the time of the halving. The halvings reduce miners’ profitability in the short term, but depending on the price of Bitcoin at the time, that reduction may not happen. Conversely, if there is no big increase in the price, mining will only be profitable to big companies that have the equipment and funding to continue operations. Ultimately, the halving acts as a type of leveller within the mining industry as some miners stop operating because of decreased returns and, in turn, the difficulty level decreases which makes it easier for new miners to enter and start mining.

What will happen when all the bitcoins are mined?

When all 21 million bitcoins are mined, which is estimated to happen in the year 2140, the miners will no longer receive bitcoins as rewards for solving complex transactions. However, they will be compensated for their work through transaction fees.

Impact on the Bitcoin network

A hashrate is a measure of the computing power used by miners trying to validate transactions and sign off blocks on a Proof-of-Work blockchain like Bitcoin. The hashrate is a key metric in assessing the strength and security of the network. More miners mean higher hashrates and therefore the mining algorithm adjusts its complexity, which means mining becomes more difficult with the more computing power that goes into it. This higher intake of miners also means a safer and more secure network as it becomes more expensive and challenging for bad actors to exploit the system. But more miners can also mean that there is centralisation when only big players can afford to mine. On the other hand, we see more decentralisation if smaller players continue to participate.

When the reward halves, then the hashrate might decline as fewer miners are participating in the network. However, if the drop in hashrate cases causes the price of Bitcoin to rise due to less supply being created, then the value of the now smaller mining reward would be increased.

A brief history of Bitcoin and Bitcoin halving dates

Genesis block established

The Bitcoin genesis block was created at exactly 18:15:05 UTC on January 3, 2009, changing the course of history. The anonymous creator(s), going by the name “Satoshi Nakamoto”, had brought a vision to life by releasing the Bitcoin whitepaper about a year before the creation of the first block. The vision of making a decentralised payment system became a reality by creating block zero, which would change how we see money and the global economy forever.

The first payment with BTC

On May 22, 2010, a hungry man made history with what was considered the first real-world payment with Bitcoin, as a Bitcoin miner traded 10,000 BTC for two pizzas. Back in 2010, BTC didn’t have much value, but as you can imagine, in today’s market, it is a huge amount of money and it is estimated that he spent about $350 million (USD) on those two pizzas! To this day, people around the world still celebrate May 22 as “Bitcoin Pizza Day”. By buying pizza with their Bitcoin, people remember the first ever BTC payment and the man who could have been a millionaire if only he chose to cook something instead.

Bitcoin market cap exceeds $1 million

On November 6, 2010, the Bitcoin market cap reached $1 million for the first time. The price per Bitcoin on Mt.Gox, the most commonly used exchange platform at that time, was $0.50. Not long after this in February 2011, Bitcoin went on to reach parity with the USD (1 BTC = 1 USD) and in June later that year, the price reached an all-time high of $31.90. This was a huge milestone for the crypto community, as the price of Bitcoin had been sitting at less than $1 earlier that year.

The first Bitcoin halving (2012)

On November 28, 2012, the first official Bitcoin halving decreased the block reward from 50 BTC to 25 BTC. One year before the halving, there was substantial interest in Bitcoin and an upward trend started in November 2011. This has been historically known as the “pre-halving uptrend” and it has seemed to become a pattern observed before Bitcoin halvings.

Bitcoin bull run

Spanning the period from November 2012 to November 2013, a year after the Bitcoin halving saw Bitcoin break a lot of records. There was an increase of more than 8,069% when the Bitcoin price reached around $1,000 (USD). This was investors’ first real experience with a bullish market, more commonly known as a “bull run” (this is when prices in the market are consecutively rising). However, in December 2013, the Bitcoin price experienced a decline of over 80% with a multi-year “bear” market. This was a tough break for investors, who did not see another positive trend until two years later.

The second Bitcoin halving (2016)

The second Bitcoin Halving reduced the block reward even further from 25 BTC to 12.5 BTC on July 9, 2016. The Bitcoin price increased by about 55% from $417 USD in April 2016 to around $650 (USD) per Bitcoin in July 2016. By January 2017 the price increased about another 40% to $920 USD.

The Crypto Winter

From the year 2018 to 2019, we experienced what is called “the crypto winter”. As a consequence, the market suffered a loss as many projects and digital assets didn’t survive 2018 and during the first couple of months of 2019, Bitcoin stayed under the $4,000 mark. This made investors believe that they were in for a long “crypto winter” in which the price would remain stagnant or even keep decreasing. This crypto winter could have also partially been a result of numerous scams that tarnished the reputation of cryptocurrency, leaving new investors unwilling to enter the crypto space.

The third Bitcoin halving (2020)

The third Bitcoin halving occurred on May 11, 2020. In this halving, the block reward was reduced from 12.5 BTC to 6.25 BTC. In March 2020, the Bitcoin price was around $5,300 before nearly doubling to $9,600 (USD) a few months later on halving day. After the halving, Bitcoin’s price continued to rise, reaching $30,000 USD by the end of 2020 and nearly $42,000 in January 2021.

Bitcoin market cap hits $1 trillion

In just 12 years, Bitcoin reached an incredible feat by hitting the $1 trillion market cap milestone. Contrary to predictions by some analysts and financial commentators who were downbeat on its prospects, Bitcoin gained major acceptance from mainstream investors and companies, including Tesla and Mastercard.

El Salvador becomes first country to adopt Bitcoin as legal tender

On September 7, 2021, El Salvador became the first country in the world to officially make Bitcoin a legal tender. The country’s legislature voted by a “supermajority” in favour of the Bitcoin Law (62 out of 84) and the price of Bitcoin was up 6% shortly after the vote. Major reasons for Bitcoin’s adoption in El Salvador included reducing reliance on the US Dollar and providing an alternative to approximately 70% of El Salvadorans who do not have access to traditional financial services.

New to Bitpanda? Get started today!

Sign up hereWhat is the long-term impact on Bitcoin?

Many believe the Bitcoin halving will result in a bull run as historical data indicates every halving event follows this cycle. Before the first Halving in 2012, we saw what is called a “pre-halving uptrend”. The 341% increase in the price of Bitcoin resulted in a bull run market, but the price crashed again in late 2013.

Once again, nine months prior to the second Bitcoin Halving in 2016, the price began increasing again up to 100% until it reached an approximate trading price of $650, again followed by a bull run. The price then increased, taking just a very brief and minor dip 12 months after the second Halving, before rising towards an all-time high.

These findings imply that there is a distinct pattern in the Bitcoin market, which is unique in terms of its predictably lower supply every four years and an overall trend towards increased demand. However, it’s also important to remember that past performance is not an indicator of future value.

Are you ready to buy cryptocurrencies?

Get started nowThis article does not constitute investment advice, nor is it an offer or invitation to purchase any digital assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in digital assets carries risks in addition to the opportunities described above.