What is Ethereum Classic?

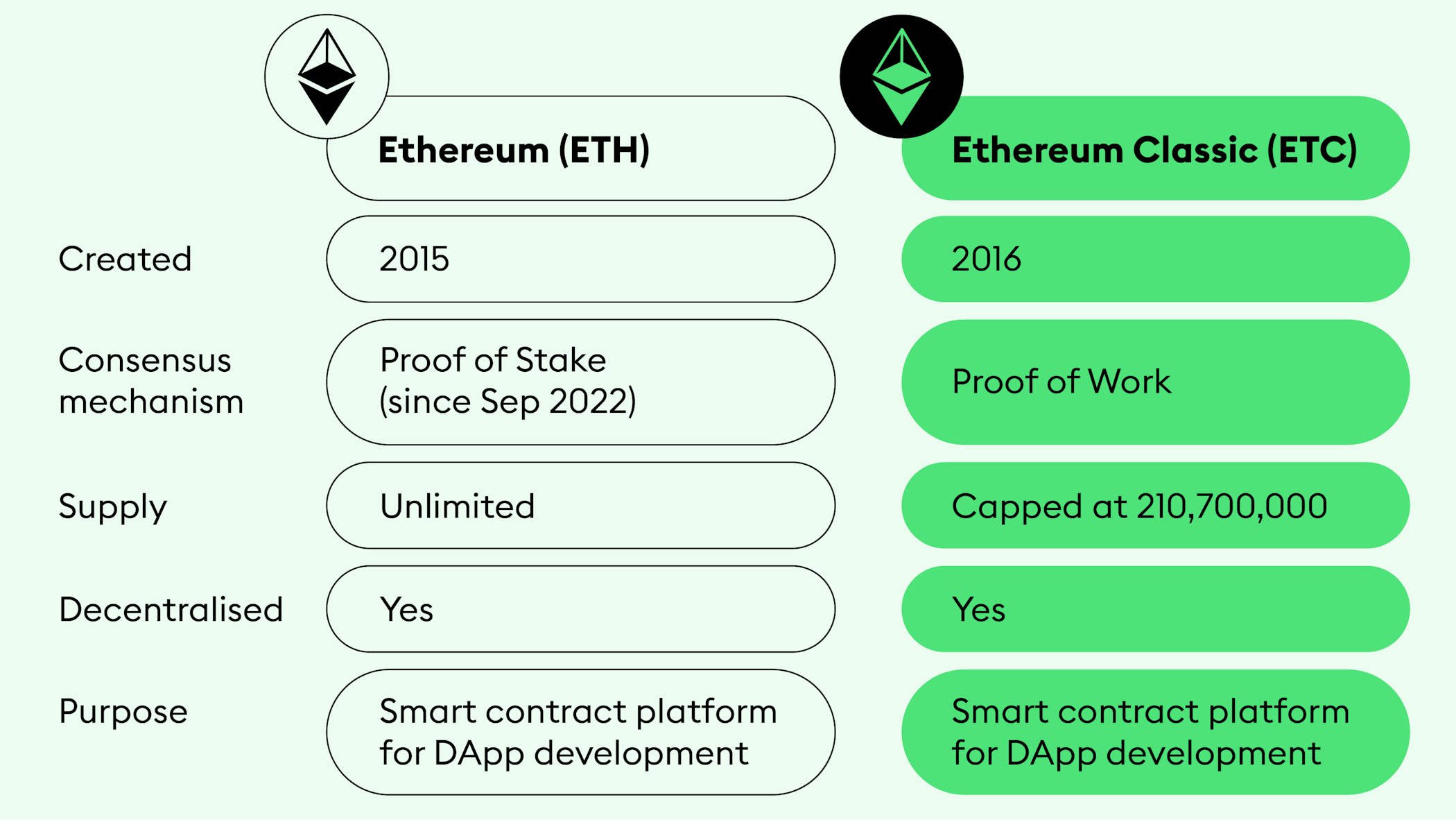

Ethereum Classic is the result of a hard fork of the Ethereum blockchain after a hack in July 2016. The founders of Ethereum and the Ethereum Foundation continued developing on a new blockchain, what the world now knows as Ethereum, but some dedicated supporters decided to continue growing the old blockchain, which they renamed Ethereum Classic.

Ethereum Classic is the legacy blockchain of the Ethereum project.

A hack in 2016 resulted in the split of the Ethereum mainnet into two blockchains: a new blockchain (Ethereum) and the original blockchain (Ethereum Classic).

Developers of Ethereum Classic are considered blockchain purists and follow many of the same principles of Bitcoin.

Although Ethereum recently switched to a Proof of Stake (PoS) consensus mechanism, Ethereum Classic still uses a Proof of Work (PoW) consensus mechanism without any plans of changing.

ETC is the token issued by the Ethereum Classic platform.

The Ethereum Classic price reached an all-time high of €111.68 on May 6, 2021

What is Ethereum Classic?

Ethereum Classic maintains Ethereum’s original mission of building a smart contract platform for the development of decentralised applications (DApps) and services. Ethereum Classic is a Turing Complete Smart Contract Platform that values the same decentralising and scaling philosophy as Bitcoin. In fact, developers of Ethereum Classic believe that the runners of Ethereum abandoned the original philosophy by hard forking and creating a new blockchain to cut off the hackers who infiltrated the mainnet in 2016. On the Ethereum Classic website, they write:

“Existing in response to contract censorship on sister chain Ethereum, Classic has proven its ability to resist censorship against all the odds, and to deliver the original Ethereum vision of unstoppable applications.”

Ethereum Classic upholds the idea that ‘Code is Law’, which means that the code of a smart contract is the “ultimate arbiter of the outcome of an on-chain interaction, as opposed to some overriding force from outside the network.” The purity of code and logic is what drives Ethereum Classic’s development and what aligns the network more closely with Bitcoin than with Ethereum. In their own words, Ethereum Classics combines “the technology of ETH with the philosophy of BTC.”

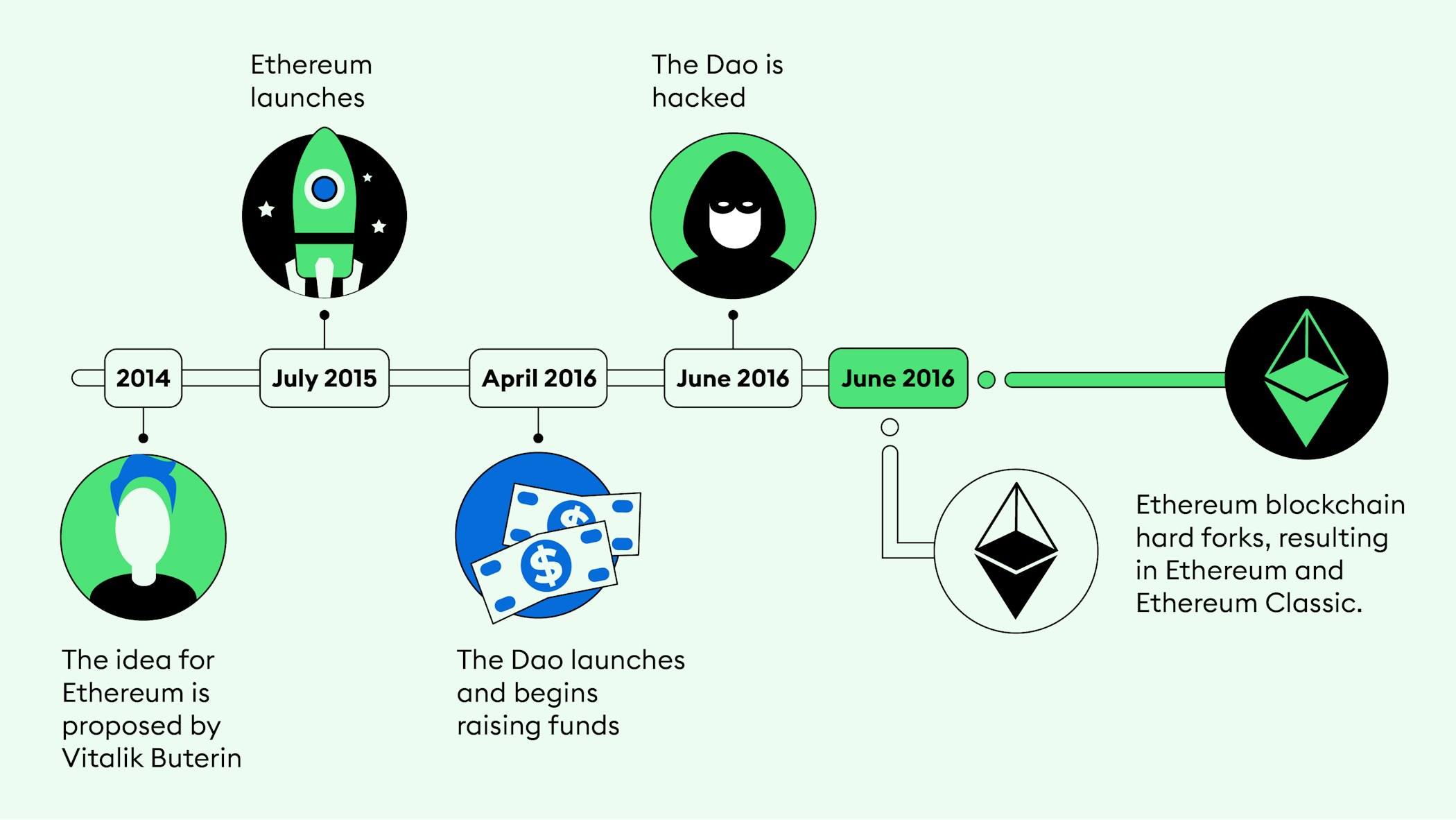

The history of Ethereum Classic

In May 2016, The DAO, a decentralised venture capital fund running on the Ethereum blockchain, raised around $168 million US dollars. One month later, a hacker exploited a security hole to move 3.6 million Ether (ETH), at that time valued at around 50 million US dollars, out of the DAO’s funds. Some of the funds were recovered. However, in July 2016, the Ethereum community voted to hard fork and create a new Ethereum blockchain in order to confiscate the remaining ETH. Ethereum Classic is the unforked version of the original Ethereum blockchain, which still contains the stolen funds.

Ethereum Classic supporters maintain that the fork was not necessary because the remaining funds could have been repossessed through other means. They claim that the Ethereum Foundation violated the founding principles of the platform, thereby placing themselves in philosophically questionable territory. Ethereum Classic positions itself as true to the original mission of building “unstoppable applications” and scaling the network for the good of the community and the development of blockchain technology.

How does Ethereum Classic work?

Like Bitcoin and Ethereum before it merged in September 2022, Ethereum Classic operates on a Proof of Work (PoW) consensus mechanism. This means that new ETC tokens are created and transactions are validated through mining. Miners earn ETC tokens in exchange for their work. No full-time team is employed to maintain Ethereum Classic. Instead, the network relies on volunteers to keep it running.

In its operating style and philosophy, Ethereum Classic resembles Bitcoin more than it does Ethereum. Both ETC and BTC maintain that their “miraculous origin” makes them impossible to recreate. Decentralisation, conservative upgrades through base layers and maintaining the “Code of Law” are of utmost importance for both crypto projects. Though both are hallmarks of technological and financial innovation, their insistence on preserving their original visions, regardless of how outdated they may appear to be at this time, can make them seem inflexible and resistant to change.

Ethereum Classic and Proof of Work

Since Ethereum Classic’s entire identity is based on preserving the original Ethereum platform as it was created, there are no plans to move to a Proof of Stake validation system. The platform calls this their pursuit of “decentralisation maximalism.” Ethereum Classic believes that PoS comes with too many compromises. When it comes to PoW, Ethereum Classic holds a certain “if it isn’t broken, don’t fix it” mentality, even though PoW is incredibly energy intensive and produces electronic waste that is detrimental to the environment. In fact, on their website, Ethereum Classic even suggests that Ethereum and other cryptos only use PoS because they are financially motivated, not because they have any regard for the environment.

How to buy ETC?

You can buy Ethereum Classic through cryptocurrency exchanges like Bitpanda using fiat currencies, e.g. euros or U.S. dollars. It’s a good idea first to get familiar with the ETC price history and the current exchange rate. Once purchased, your Ethereum Classic investment can be viewed and accessed in a digital wallet similar to a banking app. You then have the option to hold on to your ETC or sell it again via the exchange.

ETC price history

Like other cryptocurrencies, Ethereum Classic is considered a highly volatile asset. Its price has fluctuated through many highs and lows throughout its existence, and there’s no way to make a guaranteed ETC price prediction. As always, it’s important to do your own research before investing in crypto.

The price of ETC started off relatively low when it first launched, only to initially peak in early 2018. Between mid-2018 and mid-2021, the price stayed relatively constant, moving between €5 and €12. On May 6, 2021, ETC reached its all-time high of €111.68. The price dropped significantly after that and has remained volatile, trading between €25 and €43 throughout 2022. Currently, ETC is trading at an average daily high of €30.9486 and an average daily low of €27.9817. Though ETC began without a supply cap, the network voted to cap the supply of ETC in December 2017. The maximum supply of ETC is 210,700,000 units.

How to use Ethereum Classic?

Ethereum Classic has two clear use cases: It operates as a smart contract platform for developers and as a “sound money” currency, a philosophy that aligns with the founding principles of Bitcoin. As a currency, ETC can be bought, sold, held and spent online. As a platform, Ethereum Classic offers a space for developers to create decentralised apps, games and services for individuals and businesses.

What are the risks of Ethereum Classic?

Although Proof of Work generally is good at securing networks, Ethereum Classic is still a minor chain and has experienced hacking attacks in the past, including several 51% hacks, which is where a group of miners who control more than 50% of the network’s mining hashrate attack the blockchain and prevent regular mining activity to continue.

Are you ready to buy cryptocurrencies?

Get started nowThis article does not constitute investment advice, nor is it an offer or invitation to purchase any digital assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in digital assets carries risks in addition to the opportunities described above.