What is an exchange-traded fund (ETF)?

An exchange-traded fund (ETF) is made up of different securities that track an underlying index. It is a type of investment fund that is traded on a stock exchange.

A security is any type of financial asset such as a share, banknote or bond that is tradable on a securities exchange.

An investment fund is made up of various securities that have been selected to meet the objective of the investment fund.

An exchange-traded fund includes a large collection of securities and often directly replicates the performance of an underlying index.

One of the most basic types of investment funds is a mutual fund, a managed portfolio or pool of stocks, bonds and other securities that investors can buy shares in. Exchange-traded funds are taking this concept to the next level.

What are exchange-traded funds?

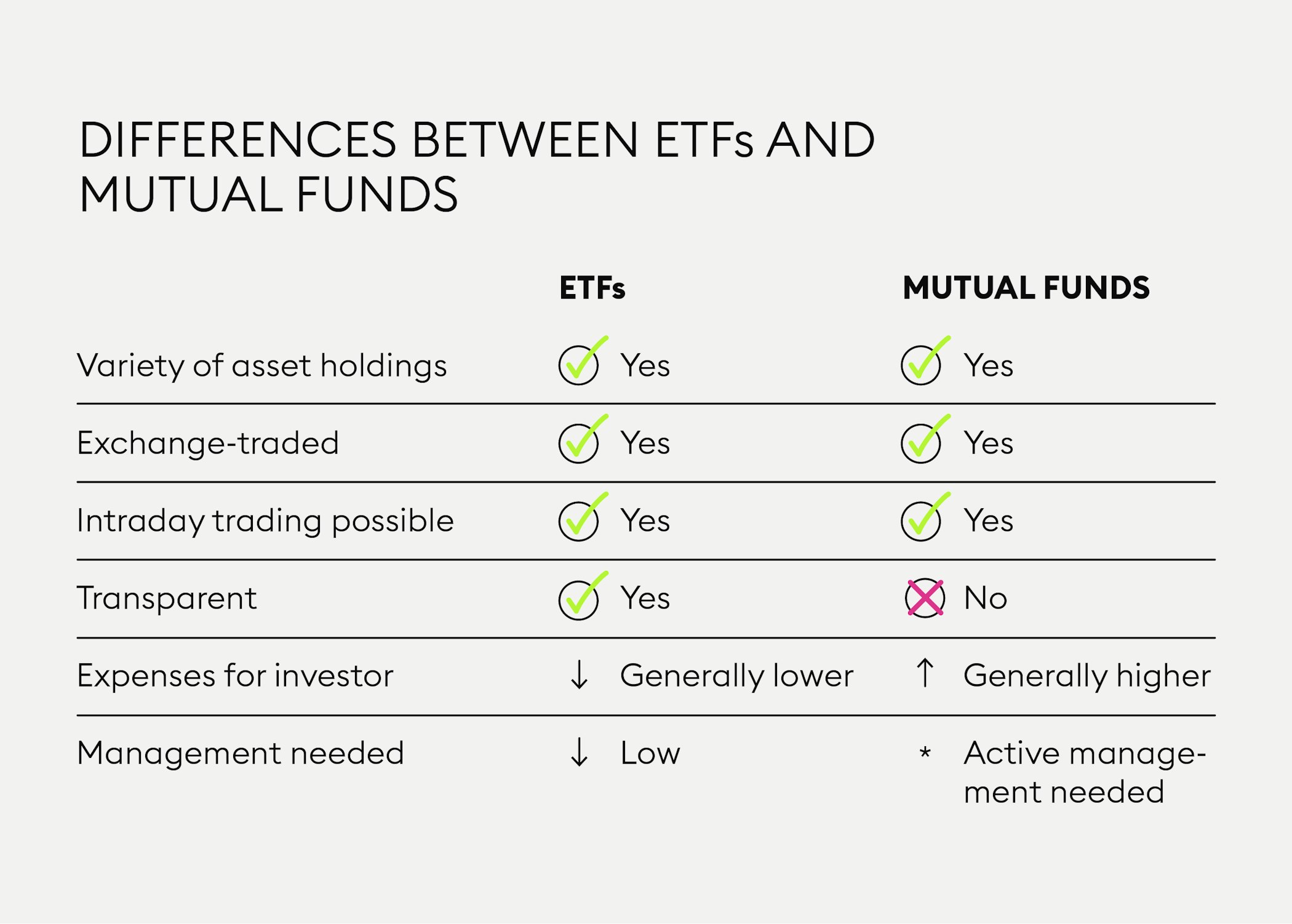

An exchange-traded index fund (ETF) is similar to a mutual fund, except that it is passively managed. An ETF includes a large collection of securities and often directly replicates the performance of an underlying index. ETFs offer individual investors easy and convenient access to entering the market. If an ETF tracks an index, the fund will develop like the index. This may obviously also be a disadvantage, as it can never (significantly) outperform the index.

When investing in ETFs, you have the choice between “distributing ETFs”, which regularly distribute income from securities, and “accumulating ETFs”, which reinvest your dividends in more securities, allowing you to profit from compounding.

Since there is relatively little active fund management involved in ETFs, expenses and fees for investors are often lower than for mutual funds that entail extensive fund management. The diversity of assets in the portfolio of an ETF portfolio and the relatively small amount of capital that first-time investors need to get started make ETFs an attractive investment vehicle.

New to Bitpanda? Register your account today!

Sign up hereWhere did exchange-traded funds originate?

The mind behind the first exchange-traded fund was Nate Most, a physicist with a background in commodity trading and an executive product developer at the American Stock Exchange (AMEX), which is today known as NYSE American. In the 1980s, AMEX was suffering from low profitability and not attracting enough business.

Looking for new ways to make profit, Nate Most came up with the idea of mutual funds that would trade like stocks. He was inspired by the simple principle behind warehouse receipts used in the trading of commodities such as gold and oil. Warehouse trading receipts show proof of ownership of commodities.

However, it took a number of years until the idea to launch the new product was realised. After resolving regulatory hurdles, cost issues and logistics, the first exchange-traded fund, the SPDRs (Ticker: SPY) was finally launched in January 1993. It went on to evolve into one of the most popular investment vehicles around the globe.

DISCLAIMER

This article does not constitute investment advice, nor is it an offer or invitation to purchase any crypto assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in crypto assets carries risks in addition to the opportunities described above.