What are candlesticks in cryptocurrency trading?

What do candles have to do with your investments? Quite a lot, actually – candlesticks, or "candles," are among the most important tools for traders in securities or cryptocurrencies when conducting technical analysis. They can provide valuable insights into market sentiment and help predict potential price movements. In this guide, you'll learn how to read candlestick charts, discover different patterns and formations, and understand how to use them strategically in trading to make informed decisions for your investments. Whether it's bullish or bearish signals, we'll explain how you can optimise your trading strategy with candlesticks.

Candlesticks describe price movements in a market over a specific period of time.

They are typically formed from opening prices, highs, lows, and closing prices of financial products on an exchange.

The “candles” usually consist of a body, a wick, and a shadow, and can form bearish or bullish candlestick trading patterns.

When combined, candlesticks create patterns that can indicate short-term and long-term price developments of an asset.

Simply explained: What are candlestick patterns?

Candlestick patterns, or formations, are visual representations of price movements used in trading to interpret market sentiment and price trends. First developed in Japan, they’re now a globally popular tool, especially helpful in crypto trading - offering quick insights into price fluctuations and potential reversals.

To recognise a pattern, you should analyse at least two candlesticks, but reviewing more often provides a clearer and more accurate understanding.

The more data you have, the better. For example, candlestick patterns that represent monthly trends are more valuable for understanding long-term movements than those showing a single day. Ultimately, the choice of timeframe should align with your trading strategy.

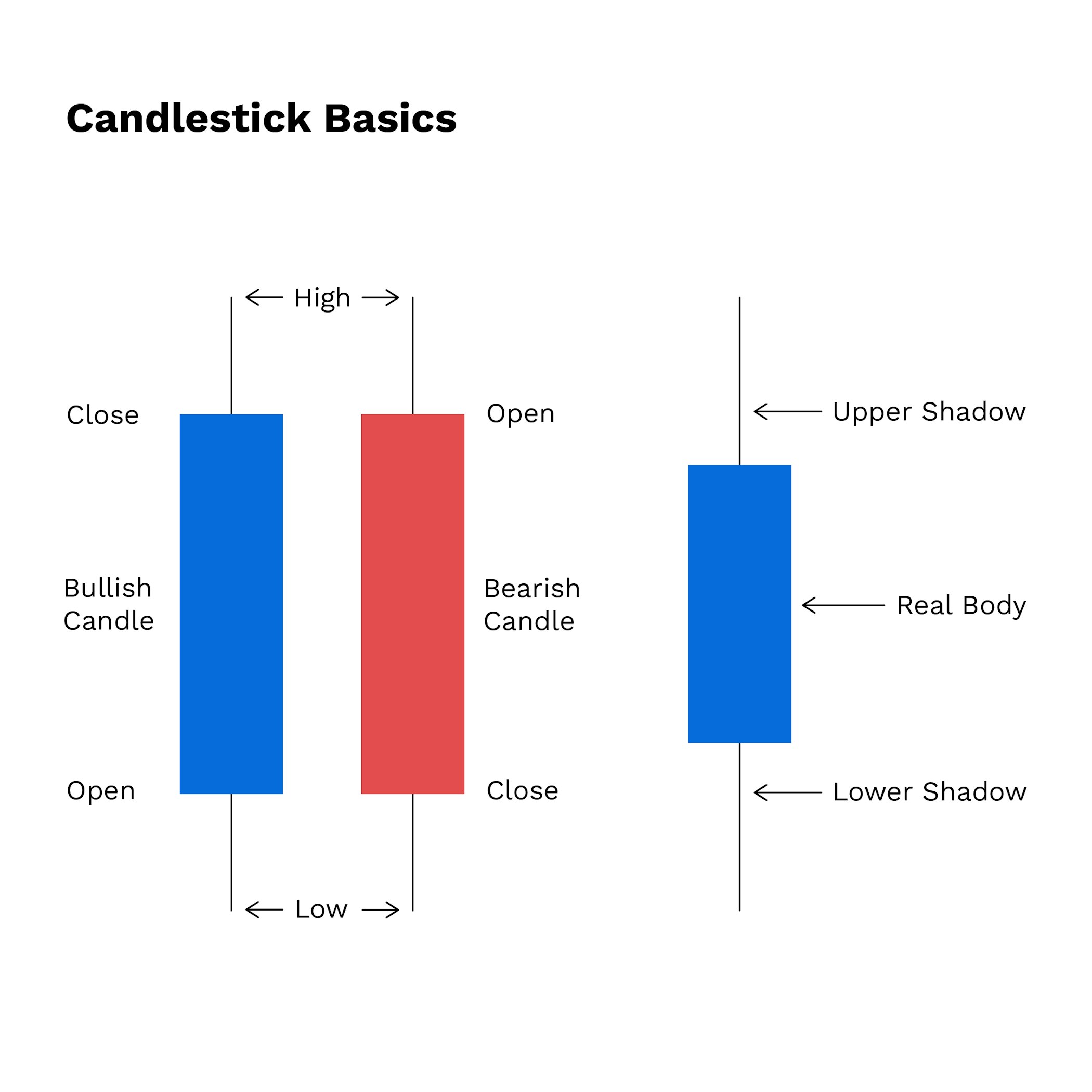

How are candlestick charts structured?

A candlestick chart visualises an asset’s price movements over a defined time period, consisting of individual candlesticks. Each candlestick reflects the opening price, closing price, high, and low of the interval. The body and shadows help determine bullish or bearish sentiment in the market.

Ready for advanced trading? Sign up for Bitpanda Fusion today.

Get started nowA candlestick includes:

Body (candlestick body): The most visible part, representing the range between the opening and closing prices over a specific time frame, such as a day, month, or hour. A solid (typically red) body indicates the closing price is below the opening price (bearish), while a green body shows the opposite (bullish).

Lower wick (shadow) and upper wick (shadow): Thin lines above and below the body that represent the high and low prices during the interval. If a candlestick lacks a wick or shadow, it means the closing price equals the high or low.

Opening and closing prices: These show where the price started and ended, providing clear insights into the market's direction and strength during the interval.

What Types of Candlesticks Are There?

There are various types of candlesticks that can provide traders with insights into market sentiment and price development. Each of these types represents specific price information and can help identify patterns and candlestick formations that indicate bullish or bearish tendencies.

Long Candles

Long candles are candlesticks with a large body, indicating significant movement in the price between the opening and closing price. If the body of a long candle is bullish (usually shown in green), it means that the closing price is significantly higher than the opening price, signalling strong upward movement. A bearish long candle (usually red) indicates that the closing price is much lower than the opening price, which may suggest selling pressure and downward movement. Long candles often indicate high market activity and trends.

Short Candles

Short candles have a smaller body, which indicates little difference between the opening and closing prices. These candlesticks suggest a market imbalance, where buyers and sellers are similarly matched. Short candles can indicate consolidation or a short pause in the market trend and are therefore often a sign of low volatility. They generally have little predictive value for future price movements.

Doji Candles

A Doji candle has almost no body, as the opening price and the closing price are nearly identical (doji = Japanese for equal, undecided). This shows a balance between buyers and sellers and is often interpreted as a sign of indecision in the market. Different types of Doji candles exist, such as the "Long-Legged Doji," where the wicks extend far beyond the body, signalling high volatility with an unchanged closing price. Doji candles are often a sign of a possible trend reversal or consolidation.

Spinning Top Candlesticks

Spinning Top candlesticks have a small body with long wicks above and below. These formations in trading indicate that there were both upward and downward movements during the time interval, but the closing price was near the opening price. Spinning Tops often indicate some uncertainty in the market, as neither buyers nor sellers dominate. These candlesticks can appear in both bullish and bearish trends and often suggest a potential sideways movement.

Marubozu Candlesticks

Marubozu candlesticks have no wick and consist only of a full body, representing the high and low of an interval (marubozu = Japanese for bald, without hair). A bullish Marubozu closes at the highest point, signalling strong upward movement and buying pressure. A bearish Marubozu, on the other hand, shows a closing price at the lowest point, indicating strong selling pressure. These candlesticks are indicators of the prevailing market direction and often point to a strong trend, as they are consistently dominated by one side – either buyers or sellers.

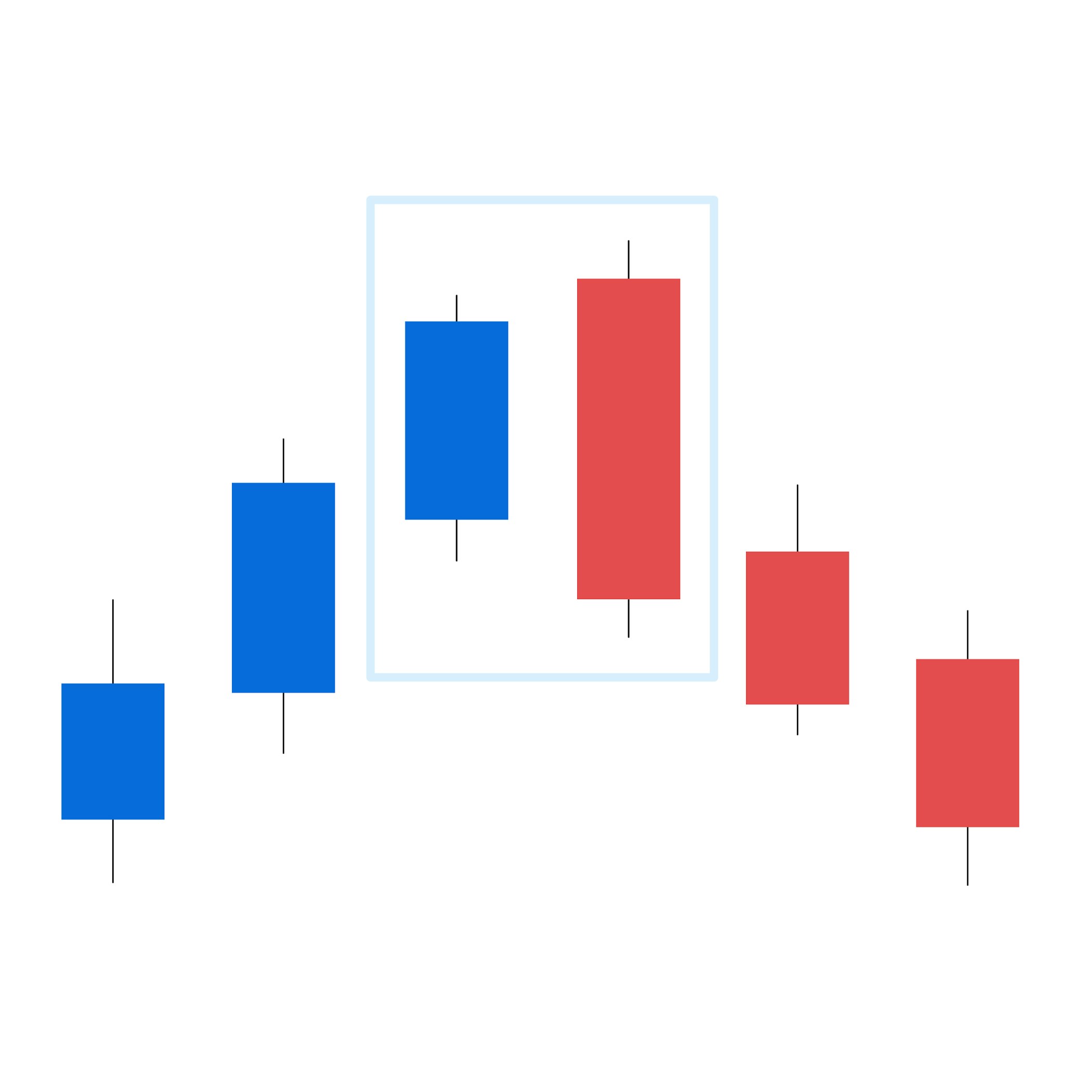

Bearish candlestick patterns

Bearish candlestick patterns are formations in candlestick charts that indicate a potential downtrend. They can serve as warning signals that selling pressure is present in the market. These patterns often emerge at the end of an uptrend and signal a possible market reversal.

One example is the Bearish Engulfing Pattern (to engulf = English for "enclose, engulf"), where a smaller bullish candle is completely "engulfed" by a larger bearish candle. These formations often indicate a shift in market sentiment.

For more details on various bearish candlestick patterns and their significance, refer to our guide on bearish candlesticks.

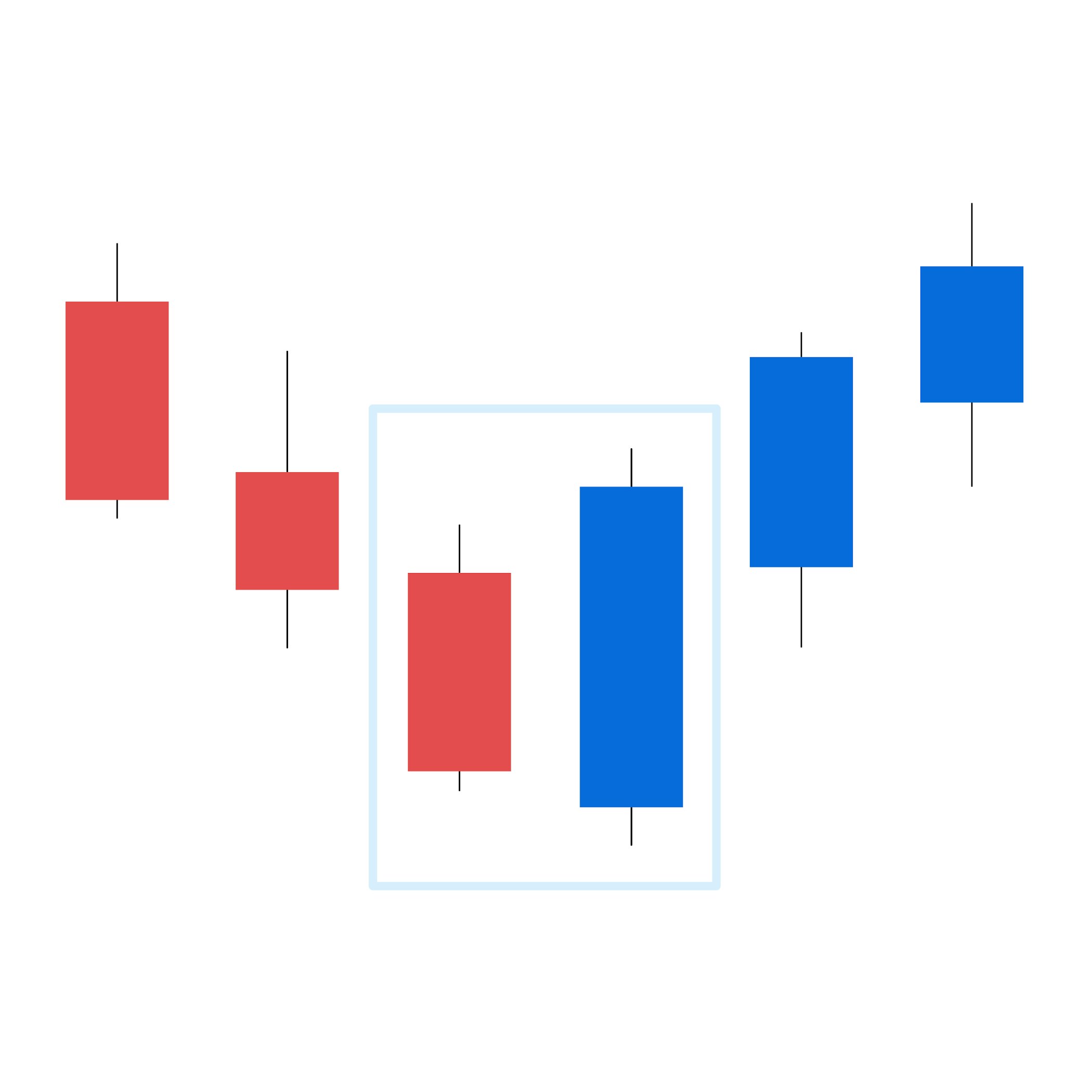

Bullish candlestick patterns

Bullish candlestick patterns appear when an upward trend in the market is anticipated, providing clues about potential positive price movements. These candle formations often occur after a downtrend and indicate that buyers are gaining control of the market.

A typical example of a bullish candlestick pattern is the Bullish Engulfing Pattern. In this formation, a large bullish candle completely "engulfs" the body of the preceding smaller bearish candle. The bullish engulfing pattern often appears after a downtrend and is considered a sign of an imminent trend reversal.

You can find details and specific examples of how to apply bullish candlestick trading patterns in our guide on bullish candlesticks.

How to read candlestick charts

Understanding how different candlesticks are composed and how they relate to each other in a chart is an important part of the technical analysis of your assets. This allows you to assess potential price movements and make more informed trading decisions.

How to Read Candlestick Charts:

Identify Trends: Observe the sequence of candlesticks to determine if the market is in an uptrend, downtrend, or sideways movement.

Identify Candlestick Patterns: Look for specific trading patterns, such as the Bullish Engulfing Pattern, which suggests a potential trend reversal after a downtrend, or the Bearish Engulfing Pattern, which often signals an imminent downtrend.

Understand Timeframes: Keep in mind that the timeframe (e.g., hours, days, or weeks) can affect the significance of individual candlestick formations. A bearish pattern on a weekly chart is often more meaningful than the same pattern on an hourly chart.

Timeframes in candlestick charts

The time unit of a candlestick chart defines how long a single candlestick represents the movement of a price. Commonly used time units are minutes, hours, days and weeks, with each time unit providing different information and perspectives. For example, a daily chart shows each day as a single candlestick, ideal for long-term traders who want to follow broader trends Minute or hourly charts, on the other hand, are popular with day traders as they show quick market movements and support short-term trading decisions.

The choice of time unit can influence the significance of the candlestick pattern. A Bullish Engulfing pattern on a daily chart usually has more significance than the same pattern on a five-minute chart, as longer time frames can provide stronger trend confirmations. Traders should therefore always choose the timeframe in the context of their strategy and objectives.

Technical analysis with candlestick charts

Candlestick charts are a vital tool in technical analysis, as they provide insights into both current price movements and potential trend reversals. In technical analysis, past price movements are examined to predict future price developments. Candlestick trading patterns such as the Hammer, the Bullish Engulfing Pattern, or the Doji Formation serve as indicators of potential upward or downward trends.

To perform a thorough analysis with candlestick charts, traders use multiple chart formations and indicators to detect market signals and combine them with other data, such as volume or moving averages. Analysing candle formations and identifying patterns can serve as a method for developing trading strategies based on price movements. This allows traders to make informed decisions in trading, thanks to candlesticks.

Conclusion: Successful trading with candlestick patterns

Candlestick patterns provide a basis for traders to recognise market movements and changes in sentiment at an early stage. Understanding candlestick patterns and formations such as the bullish engulfing pattern, doji, hammer and others makes it possible to identify trends and possible reversal points in the chart. By specifically reading and interpreting candlestick charts, traders can not only better interpret individual signals, but also apply more comprehensive technical analysis techniques.

For successful candlestick trading, it is important that you familiarise yourself with the different time frames and their influence on pattern reliability. In combination with other trading indicators, such as trading volume or moving averages, candlestick patterns help you to make informed decisions and better weigh up risks.

Frequently asked questions about candlesticks

Here you will find answers and explanations to the most frequently asked questions about candlesticks.

What Are Candlestick Formations?

Candlestick formations, or candle formations, are recurring patterns in candlestick charts that help traders forecast potential price movements. They consist of individual or multiple candlesticks and are used in technical analysis to identify bullish or bearish market sentiment at an early stage.

These formations often indicate whether an upward or downward movement is imminent. Some formations, such as the Engulfing Pattern or the Doji, suggest a potential trend reversal, while others, like the Hammer, indicate a continuation of the current trend. Candlestick formations are therefore a valuable addition to technical analysis, helping traders better understand market movements and make more informed trading decisions.

Is There a Difference Between Candlestick and Chart Formations?

Yes, there is a difference between candlestick and chart formations. Candlestick formations consist of individual candlesticks or a small series of candlesticks and indicate short-term changes in sentiment or potential trend changes. Typical candlestick formations are the bullish engulfing pattern, the hammer or the doji. These patterns tend to be small-scale and offer a quick assessment of market sentiment.

Chart formations, on the other hand, usually cover longer periods and are made up of a large number of candlesticks or other chart types. Examples of chart formations are the head and shoulders formation, the triangle or the double bottom. Chart formations help traders to recognise overarching trends and develop longer-term strategies. Together, candlestick formations and chart formations in trading can provide a more comprehensive picture of the market and support traders in technical analysis.

What Is the Best Candlestick Formation?

The question of the "best" candlestick formation cannot be answered definitively, as the reliability of a formation depends heavily on the specific market context and the timeframe. Commonly used and considered reliable formations include the Hammer, the Bullish Engulfing Pattern, and the Doji, as they often indicate potential trend reversals.

More trading topics

Interested in strategies to take control of your investments and capitalise on cryptocurrency trends? Explore our resources in the Bitpanda Academy for in-depth guides on blockchain, crypto trading, and more.

DISCLAIMER

This article does not constitute investment advice, nor is it an offer or invitation to purchase any crypto assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in crypto assets carries risks in addition to the opportunities described above.