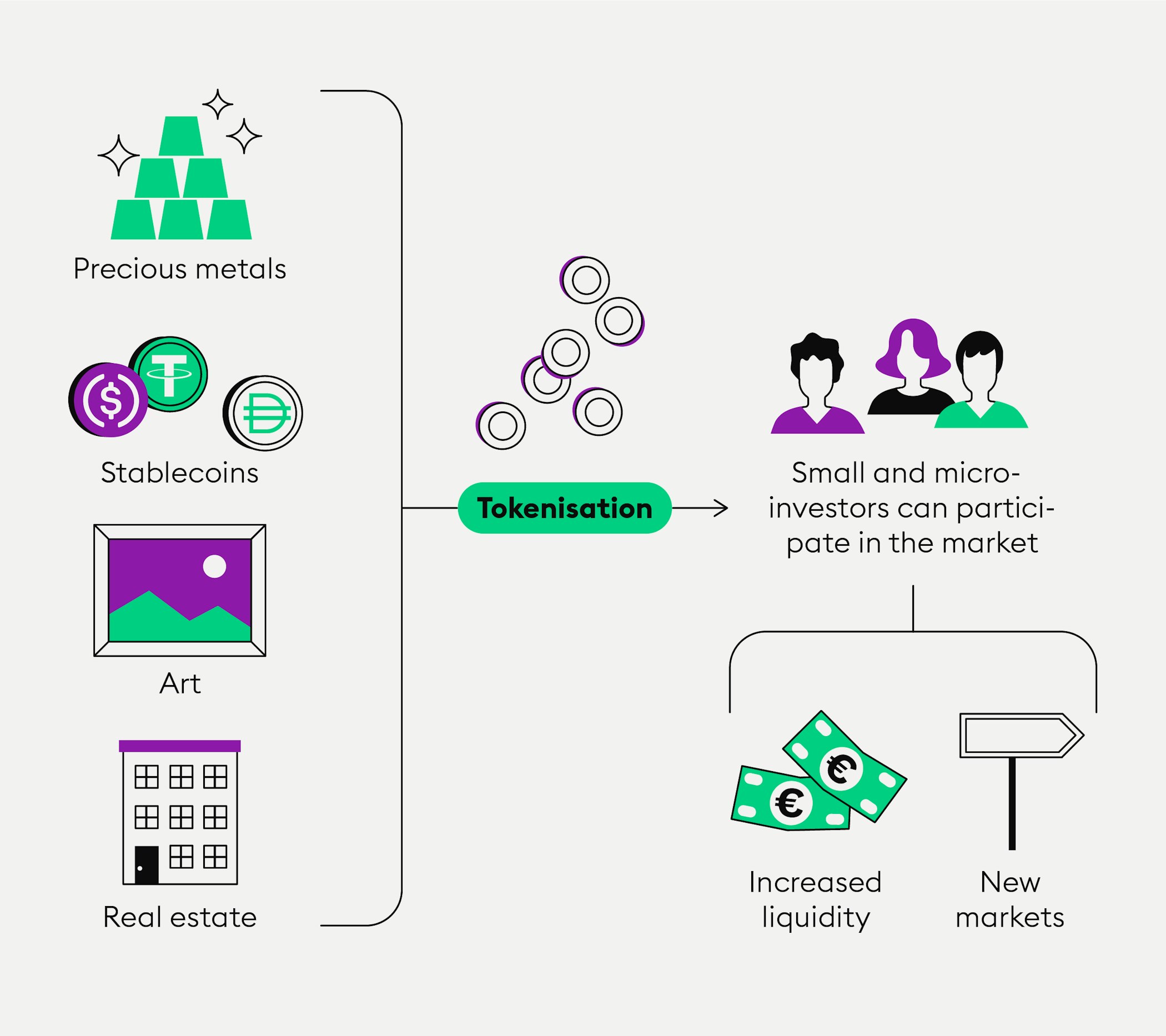

How tokenisation could democratise investing

In line with the world’s transition towards digitalisation, the securitisation process of ownership of assets is evolving as well. Instead of a "physical" document, certain conditions under certain circumstances are digitally represented by a digital token.

In the blockchain space, tokenisation refers to the act of the digital securitisation of assets

Currently, numerous tokenisation projects are driving the fintech industry, many of which are still in a nascent stage

The regulated tokenisation of assets could open up investing to a large group of new investors that were excluded from the markets until now

In this article, we are going to explain what tokenisation is and why it matters for the future of finance.

What is a basic definition of tokenisation?

An asset is anything considered to be of monetary value to at least two parties and has the ability to be interchanged with another asset of the same type, meaning it is “fungible”. An asset could be a certain good, physical object or right itself.

Fungible assets were essential for the evolution of commerce and the world of finance. The goal was to make the exchange of commodities as easy as possible. Money was invented for this reason; first to facilitate transactions for assets that were too cumbersome to exchange directly and eventually as a convenient medium of exchange.

Securitisation of assets

As the traditional world of finance evolved, a process to ensure in writing in a document which party was holding the rights to an asset. This process is the most general definition of the term “securitisation”. It means securing in writing on paper what asset belongs to who and under which circumstances.

In the world of finance, securitisation enables a company wanting to issue its assets or parts of its assets to other parties as products they can invest in. Through securitisation, these assets are then considered investment products which can be bought, sold and traded as “securities”.

In line with the world’s transition towards digitalisation, the securitisation process of ownership of assets such as goods, physical objects or rights is rapidly evolving as well. Instead of a "physical" document, a digital token is programmed to represent certain circumstances under certain conditions in digital form. An example is holding the rights to an asset: who an asset belongs to when certain parameters are met.

Digital tokens

Blockchain technology provides the foundations for issuing digital tokens: utility tokens on the one hand, and security tokens on the other. A utility token may grant rights to receive preferential treatment to a type of special service or to redeem it. A security token, also referred to as an “investment token” or “equity token”, is tied to a securities offering as defined in the Howey Test.

Smart contracts allow for instantaneous and decentralised settlement.

Thanks to the ERC20 token standard - the currently underlying format for most token-based projects - smart contracts are employed as self-enforceable, digital representations of traditional contracts. Smart contracts create tokens and map all conditions of transactions, such as the self-execution of such a contract once certain criteria are met, allowing for instantaneous and decentralised settlement.

Why are assets tokenised?

Based on the ERC20 standard and smart contracts, developers around the world began to realise that just about anything could be made into a token or “tokenised.” This tokenisation revolution started with the emergence of altcoins. It then evolved towards the creation of stablecoins, security tokens, tokenised metals and to determining many more opportunities. Currently, numerous tokenisation projects are driving the fintech industry, most of which are still in a nascent stage.

Stablecoins

A stablecoin is a cryptocurrency that is pegged to the value of a leading fiat currency such as the US dollar or another asset that is considered to have a stable value. This way, the stablecoin itself is projected to hold the same stable value.

As a fact, stablecoins were established with the purpose of eliminating the volatility of traditional cryptocurrencies by consistently holding a stable value while simultaneously being backed up by the equivalent amount in fiat currency. Thanks to this feature, stablecoins are projected to play a key role in the tokenisation of assets by serving as connecting elements in transactions involving the tokenisation of real-world goods and fiat money.

Real Estate

One of the driving forces behind tokenisation is the anticipated disruption of the real estate industry as demonstrated by the example of Tezos and its real estate tokens. Considered a non-fungible asset before ERC20 and smart contracts, the buying or selling of real estate was only possible in set denominations such as the entire property or units of a property. In terms of investing, the tokenisation of real estate offers two major advantages.

Before ERC20 and smart contracts, the buying or selling of real estate was only possible in set denominations such as the entire property or units of a property.

For one, the regulated tokenisation of real estate could open up investing in real estate to a large group of new investors that were excluded until now, thus providing the next step to democratising investing. By fractionalising property into theoretically as many smaller denominations as desired, even micro-investors - investors with very small budgets - can start investing in assets that were previously out of bounds to their budget.

New to Bitpanda? Register your account today!

Sign up hereNew markets and liquidity

Let’s illustrate some of the possibilities that blockchain technology offers in this regard. Imagine micro-investors being able to invest in large-scale building projects. What are the implications? For one, this would lead to the creation of entirely new markets. Thanks to fractionalisation, real estate trading could also enter new realms. Or just think of hundreds of people investing in a forest to protect the environment and to fight against climate change.

Furthermore, the tokenisation of real estate is bound to positively affect the low liquidity associated with real estate investing, as new investment vehicles enable easy buying, selling and trading of fractionalised shares in property in a highly transparent and efficient way.

Precious metals

The dual principle of fractionalisation and tokenisation also applies to metals since they are historically difficult to both trade and own at the same time. While investing in gold ETFs has been possible for a while, the digitisation of precious metals has opened up investing in gold, silver and other precious metals to investors who are just getting started in investing.

Here at Bitpanda, you can purchase tokens that give you access to and true ownership of certain amounts of digitised gold, silver, palladium and platinum. All metals that can be bought on Bitpanda are backed physically and stored safely in a high-security storage facility in Switzerland.

All metals you buy on Bitpanda are physically backed and safely stored in a high-security storage facility in Switzerland.

Art

While buying artwork has also traditionally been a privilege of the truly wealthy, tokenisation of works of art would also open up investing in art to a whole new audience. On the other hand, increased liquidity as a result of selling fractions of a work would benefit artists and creators alike, driving exposure of the artists’ work to the public and lowering the barriers for would-be investors to purchase works of art.

As a matter of fact, the list of assets that could be tokenised seems to be nearly endless, from all kinds of traded securities over sports teams, to luxury goods, to cars, patents, licences and basically any kind of asset where fractional ownership is possible.

What are the barriers to tokenisation?

Above all, tokenised assets are considered to be even more nascent than cryptocurrencies.

While the rewards are many, for the tokenisation of assets to become mainstream, new and aligned regulatory frameworks on an international scale, including definition of custodianship and supervision, are vital prerequisites for democratised investing.

Currently a part of the players in legacy financial systems regard the tokenisation of assets as being juxtaposed to their interests, leaving them oblivious to the new opportunities decentralised and democratised investing offer. Other concerns regarding tokenisation of assets are apprehension about stability issues in case of highly liquid markets, security and risk issues, trust issues, and network scalability. As well, this highlights the need for public investment in financial education to reach new investor groups.

In any case, the tokenisation of assets is bound to fundamentally change the power dynamics of financial markets in the decades ahead, diminishing monetary barriers for small investors, opening up new markets and opportunities and broadening investor bases with the true potential to break down the barriers to investing.

DISCLAIMER

This article does not constitute investment advice, nor is it an offer or invitation to purchase any crypto assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in crypto assets carries risks in addition to the opportunities described above.