What is an exchange-traded cryptocurrency note (ETN)?

You might have heard of ETPs, ETFs, ETCs and ETNs, but what are these financial instruments exactly? How can they facilitate exposure to assets like cryptocurrencies for investors? Let's explore some of the key differences between the four.

Cryptocurrency exchange-traded notes (ETNs for tracking crypto, for short) make crypto exposure accessible to all investors while mitigating risks such as wallet hacks and risks that may be involved in asset storage.

ETNs are traded in a familiar securities environment such as trading platforms of stock exchanges

Investors invest in ETNs via brokers or regular banks.

In this article, we are going to look at cryptocurrency exchange-traded notes and their features.

An increasing number of investors consider cryptocurrencies an essential part of a portfolio that is well-diversified. As the adoption of cryptocurrencies is progressing, investors are looking for further options to gain exposure to this asset class. Exchange-traded products such as ETFs have been established vehicles within the financial industry for decades.

Traditionally used to back assets such as metals and commodities, exchange-traded product structures can also be harnessed to wrap cryptocurrencies into exchange-traded securities. This offers investors the opportunity to gain real physical crypto exposure within an established and familiar infrastructure, for instance via a broker or a bank.

An ETN tracking crypto: a new way to invest in crypto

While cryptocurrencies are generally traded on dedicated crypto exchanges with assets held on an exchange wallet or transferred to an investor's private crypto wallet, many traditional investors are looking to invest in crypto but still find crypto exchanges, wallets and the storage of assets to be daunting and risky.

Cryptocurrency exchange-traded notes (short: ETN) offer investors an alternative to invest in crypto while mitigating risks such as wallet hacks and risks that may be involved in asset storage. The notes are traded in a familiar securities environment and offer the same level of transparency and liquidity as any other exchange-traded product. The “physical” cryptocurrency backing up the product is kept safe by mandated regulated professionals.

Traditionally used to back assets such as metals and commodities, exchange-traded product structures can also be harnessed to wrap cryptocurrencies into exchange-traded securities.

What do ETP, ETF, ETC and ETN stand for?

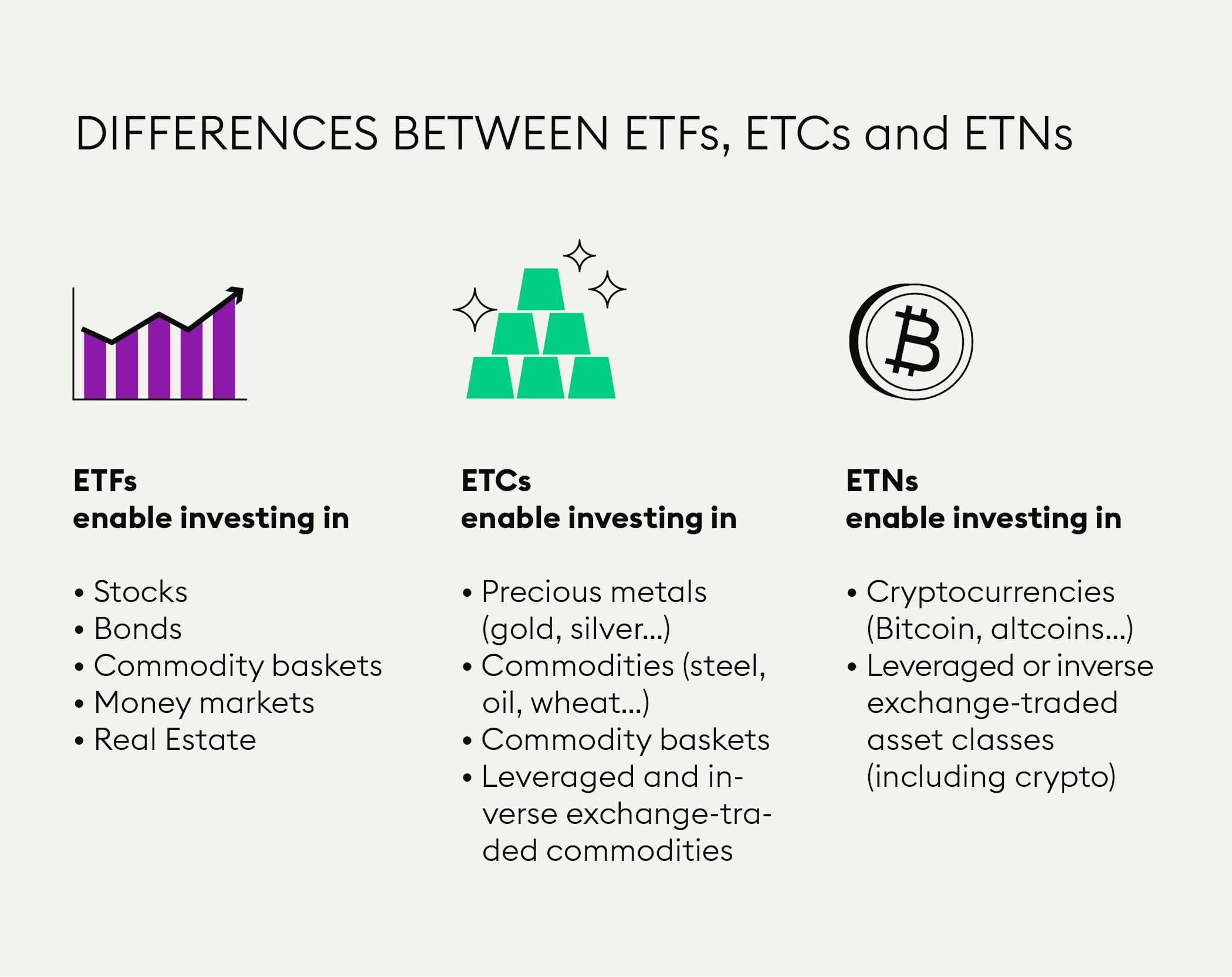

The acronyms ETP, ETF, ETC and ETN are often used interchangeably in the exchange-traded products space, but they are fundamentally different products. Let's take a closer look at them.

ETP (exchange-traded product)

The letters ETP are short for "exchange-traded product", the umbrella term for all of the following categories. Essentially, any exchange-traded security that replicates the value of another underlying asset can be called an ETP. The concept has been in existence for several decades, with the first gold-backed notes traded in 2003.

ETF (exchange-traded fund)

Exchange-traded funds (ETF) make up the largest and best-known category of exchange-traded products. Since the issue of the first modern ETF in the 1990s, ETFs continue to grow more popular and are globally among the most sought-after type of investment by retail investors.

For the most part, ETFs invest passively, meaning they implement an investment strategy automatically based on a set of predefined rules without the help of a portfolio manager. Like in the case of classic investment funds (like mutual funds), ETF share qualifies as equity in the fund and represents partial ownership of a fund's assets.

ETC (exchange-traded commodity)

An ETC (exchange-traded commodity) offers investors exposure to commodities such as goods, metals and livestock.

New to Bitpanda? Register your account today!

Sign up hereETN (exchange-traded notes)

ETN stands for exchange-traded note. ETNs are another type of exchange-traded products but with a somewhat different legal structure. Instead of equity in the fund, each traded note of an ETN represents obligation from a legal entity holding the underlying asset as collateral. They are effectively debt securities.

Because of their structure, ETNs precisely replicate an underlying asset's value. They allow investors to gain exposure to assets that are not regulated securities through the use of a regulated exchange. Such assets may be precious metals such as gold, silver or palladium, or, in our case, cryptocurrencies.

Despite the highly volatile nature of cryptocurrencies, interest in investing in crypto for portfolio diversification is increasing as some coins have been outperforming many other assets over the past few years.

A cryptocurrency ETN is a type of ETN that is 100% secured by one (or several) crypto assets and represents a claim to a fixed amount of the underlying asset(s). By investing through an ETN tracking crypto, investors can obtain exposure to physical cryptocurrency via their regular brokers or banks. They also offer a further layer of liquidity.

The disadvantage of owning an ETN is that investors have less control over their asset which is why it is essential that you do your research to ensure that you are purchasing your ETNs from companies with an impeccable reputation and institutional level safety and security processes.

Although ETNs charge an annual fee, holding crypto in a personal wallet comes at a similar cost thanks to transaction and network, including custody charges associated with securing a personal wallet. ETNs may also, albeit rarely, suffer from tracking errors because their prices are driven by both the underlying asset as well as supply and demand mechanics.

DISCLAIMER

This article does not constitute investment advice, nor is it an offer or invitation to purchase any crypto assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in crypto assets carries risks in addition to the opportunities described above.