What is a bond?

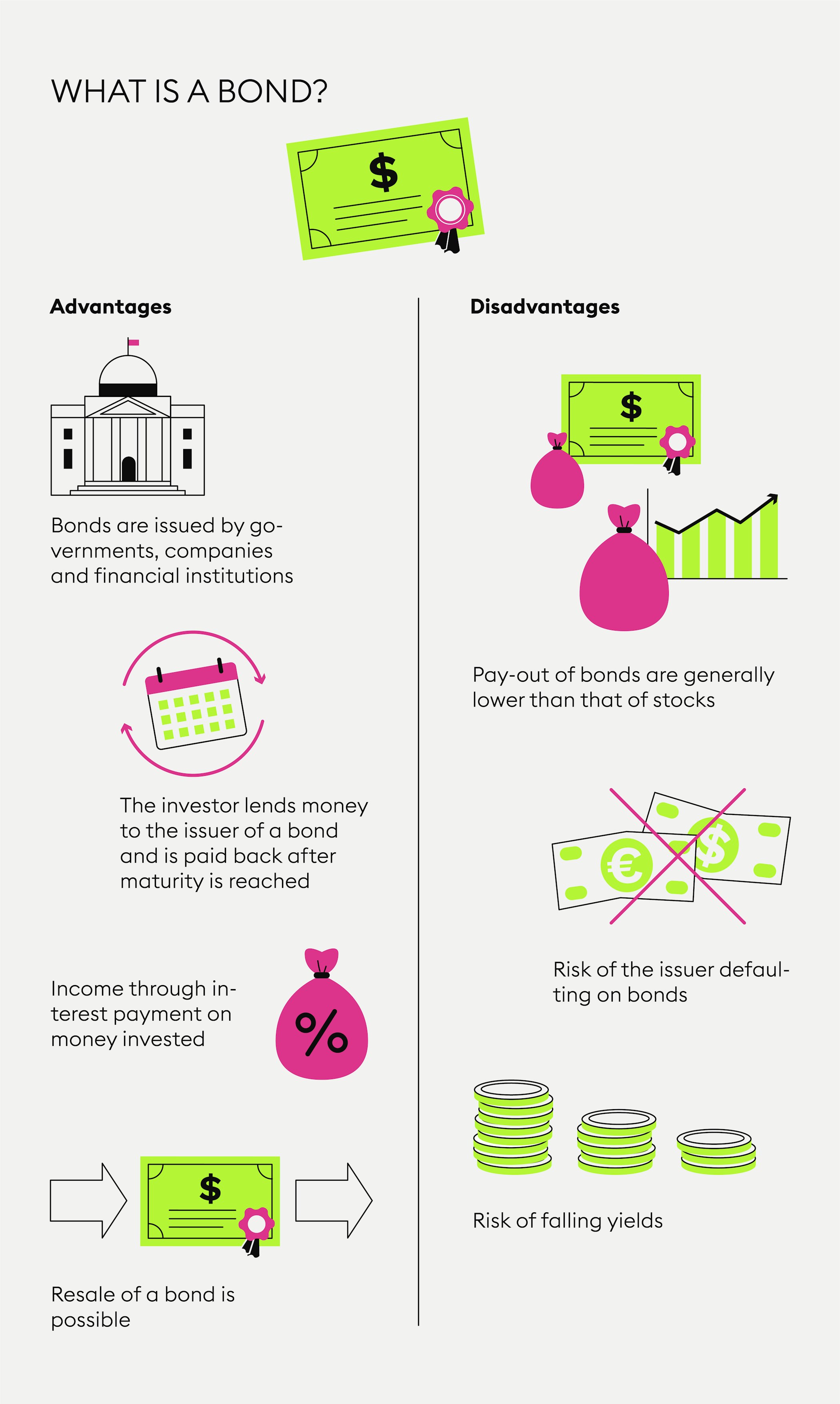

A bond is a security that functions as a contract between two parties: the issuing party (a company or government) borrows money from the investor and then pays it back with interest after the bond has reached maturity.

A bond is a type of loan contract that outlines the amount, the interest rate and the maturity date of the loan between a debtor and a creditor.

Money from bonds is used by governments mainly for long-term debt financing or for the funding of infrastructure projects.

Large companies may issue bonds to fund expansion or to maintain operations.

The investor is therefore a creditor of the issuer and has the right to the repayment of the money they invested.

Bonds are considered a low to medium-risk investment because they are usually stable but are subject to interest rate risk.

What is a bond?

A bond (or debenture bond) is a security that functions as a contract between two parties. Imagine a company or a government that wants to borrow money. The company or the government issues bonds to investors. The investor buys bonds and thereby lends the company or the government money for a certain amount until a certain date and receives interest payments on the money they invested.

An annual or semi-annual interest payment to the bondholder is called a coupon. Zero-coupon bonds, on the other hand, do not issue periodic payments to bondholders, hence the name. In this case, interest is automatically compounded until the maturity date - the date the final payment of the bond is due.

After a bond has reached its maturity date, the issuing company or government pays the investor back their money. Becoming a shareholder means the investor can become co-owner in a company. In this case, the investor becomes a creditor that lends money to the issuing party.

Where did bonds originate?

Bonds date back several thousand years, possibly as far back as 2400 BC. In 1693, the Bank of England issued the first government bond to raise funds for a war against France. Over the last centuries, bonds have been commonly used to fund wars and other types of government spending.

Are bonds traded on a stock exchange?

A financial market is a generic term for markets on which trading with financial instruments takes place. Fundamentally, financial markets can be classified into different categories. The three main markets are: money markets, capital markets and foreign exchange markets.

The capital market is further broken down into equity markets and bond markets. Equity markets are for exchange trading and over-the-counter trading (OTC trading) of stocks.

The sale of securities at the time they are issued in a public listing is referred to as the primary market. Trading on the exchange a company is listed on or over-the-counter trading is referred to as “secondary market” or “aftermarket”. This is the financial market on which financial instruments such as stocks, bonds, futures and options are bought and sold.

The company or government issues securities in the form of bonds to the investors - the creditors - on the primary market in return for their investment capital. Issued bonds can then be resold on the secondary market.

New to Bitpanda? Register your account today!

Sign up hereWhat are common types of bonds?

Besides federal bonds, governments can also issue state bonds and municipal bonds.

For funding company expansions, financing or to increase operations companies issue corporate bonds. Companies are increasingly issuing corporate bonds for supplementary credit to their existing credit lines without needing to give up company shares.

Finally, financial institutions may issue banking bonds for raising capital, often for refinancing. Investors in banking bonds lend money to the bank and regularly receive interest in return. The bank then repays the loan once the bond reaches maturity.

Why investors invest in bonds

Many mutual funds include bonds and bonds as such are popular securities for portfolio diversification, still you should consider the risk involved in investing. Investing in a government bond, for example, is considered relatively safe because the state issuing the bond is liable for it. However, the degree of safety may depend on the political stability of the nation behind the bond.

Bonds are rated by rating agencies who measure the financial strength of the issuing party and indicate the credit standing of the party by using letters, symbols and numbers. Standard & Poor’s, Moody’s and Fitch are considered as the three most important rating agencies.

All in all, you should definitely analyse the credit standing of the party issuing a bond, regardless of whether it is a company, a government or a financial institution. Selling a bond before it reaches maturity is usually possible but may involve a “price loss”. A rule of thumb is also that the higher the interest rate offered for a bond, the greater the risk involved. As with all investments, don’t forget to bear in mind fees for buying and selling, as well as taxation.

DISCLAIMER

This article does not constitute investment advice, nor is it an offer or invitation to purchase any crypto assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in crypto assets carries risks in addition to the opportunities described above.